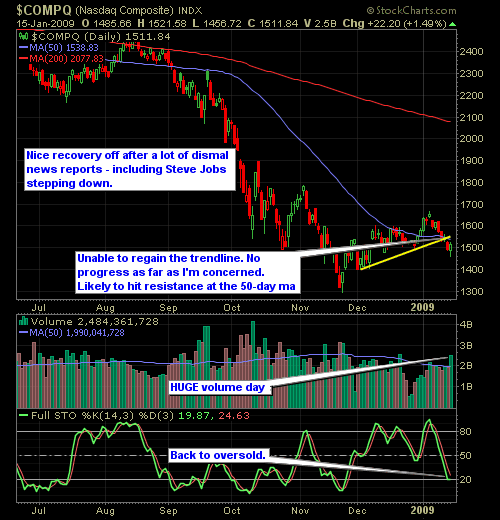

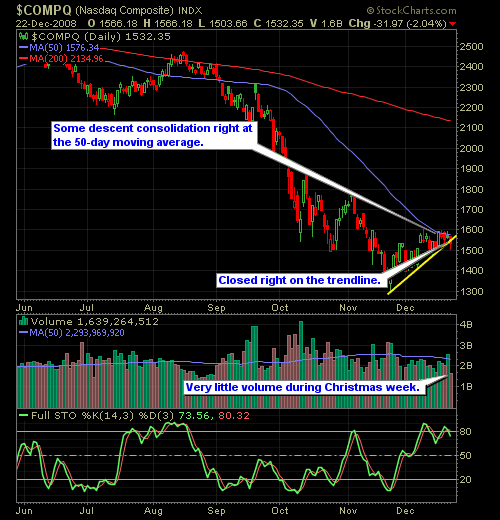

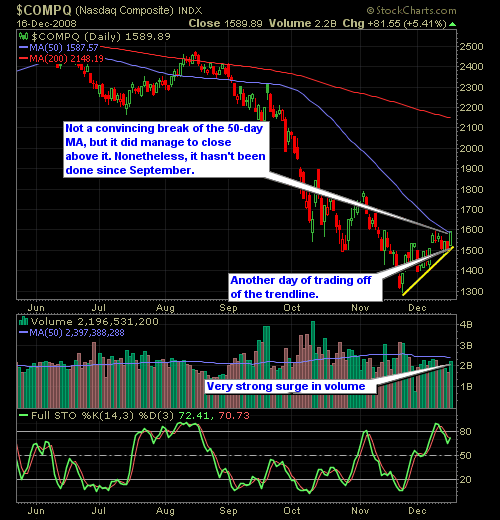

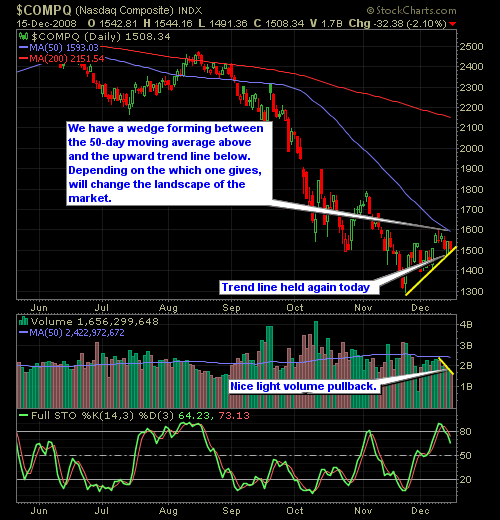

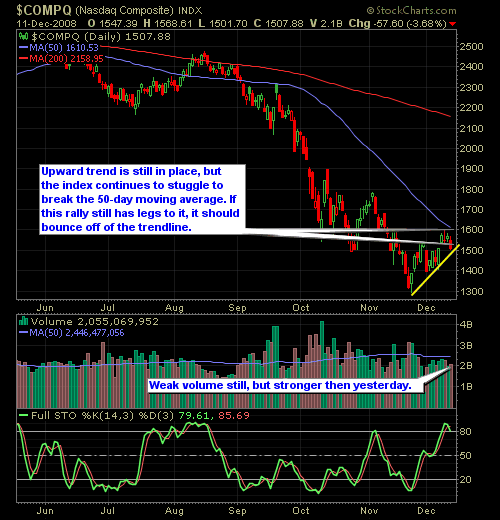

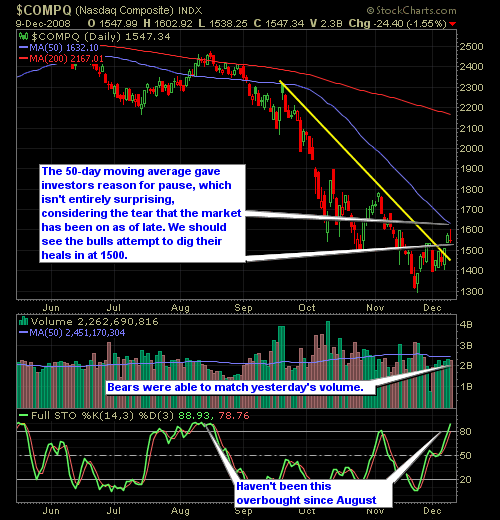

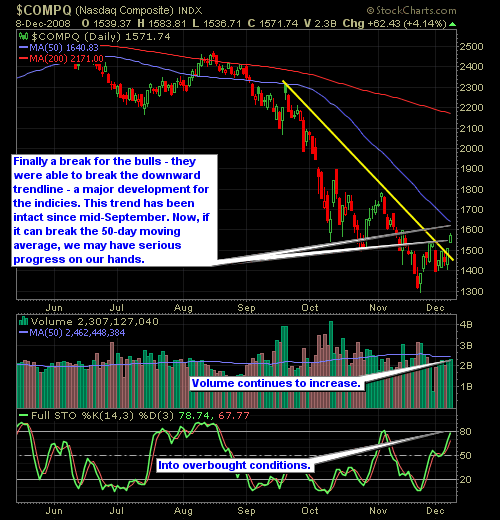

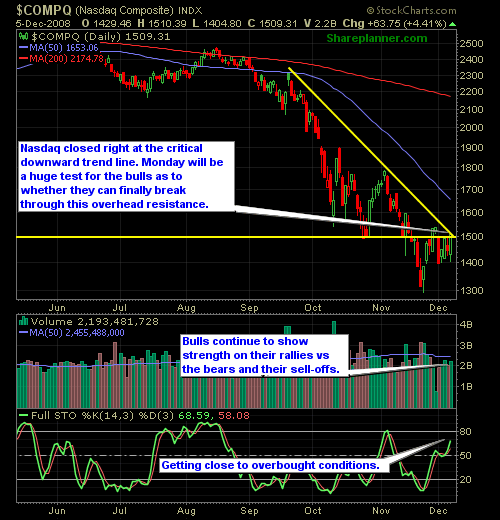

Trend Still Broken Following Rally

Today was probably more of a rally due to the general markets being oversold, than it was about the markets having a sudden change of heart in regards to the conditions affecting our economy and stock market. However, I wouldn’t be surprised to see some a few more days of [...]