Swing-Trading Strategy Report #480

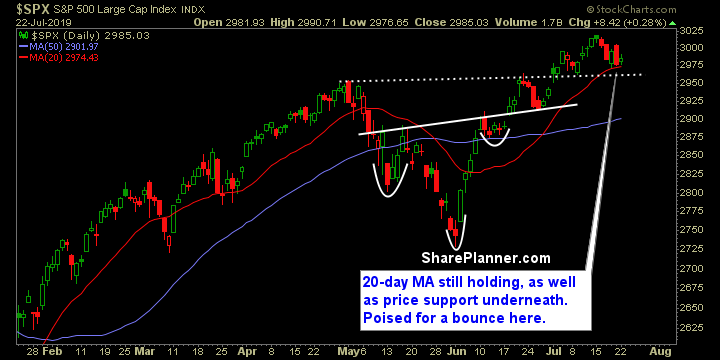

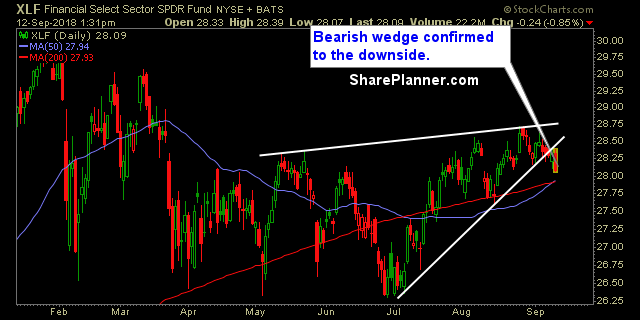

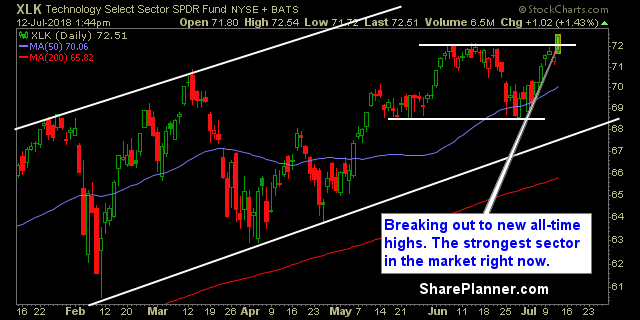

My Swing Trading Strategy I added some financial exposure yesterday, and will consider adding more long exposure today, should the market conditions warrant it. Indicators Volatility Index (VIX) – VIX sold for two straight days, and 6.8% yesterday alone, with the potential to see a retest of 12.00 in the very [...]