Short Setup Watch-List of Stocks That Just Can’t Do Anything Right

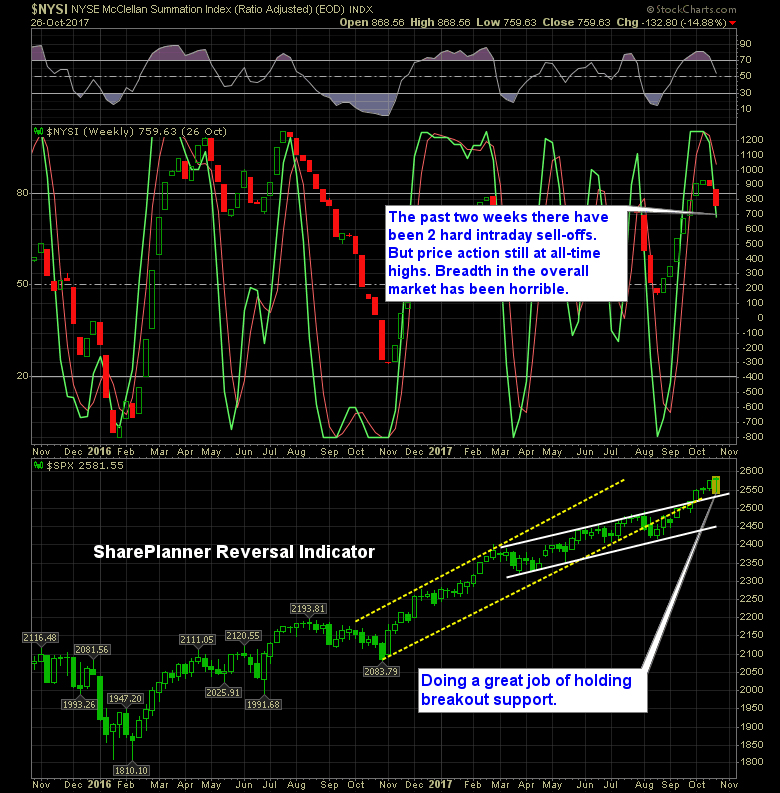

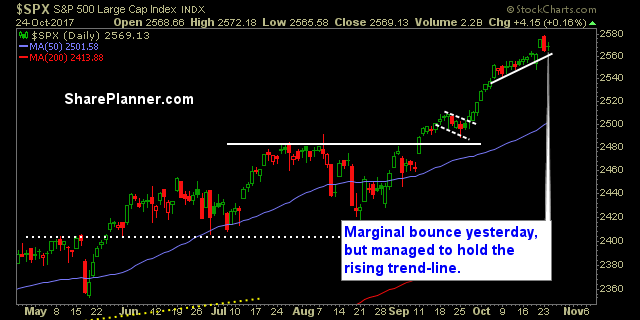

A two-day pullback has become a generational buying opportunity for this market. You can’t get any more than that without a rip-your-face-off rally thereafter. The dip buyers, the algorithms, the Robinhood Bro’s – the only thing they know to do is to buy the dip. No volume, no problem, they [...]