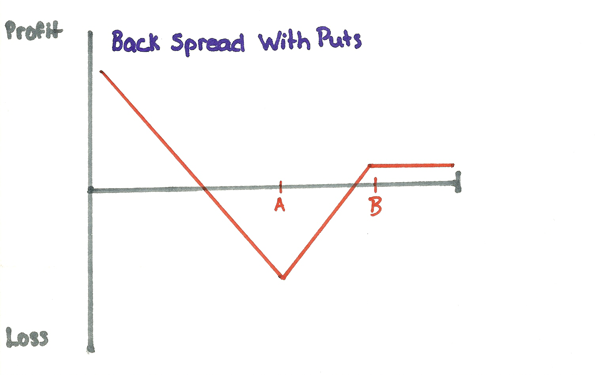

Name: Back Spread w/ Puts

Setup: Buy (long) 2 Strike A puts and Sell (short) Strike B put – contracts will have the same expiration

Bias: Very Bearish

Break-Even: Two break-even points:

- Strike B – Strike A – Credit received

- Strike B – Credit received

Max Profit: Limited – Max profit if stock goes to $0

Max Loss: Strike B – Strike A – Credit received

Margin: Margin requirement equals the difference between the strikes of the short put spread

Time Decay: Time Decay is mixed on this play and depends where the underlying price is relative to the strikes. If the underlying is above Strike B then time decay is a positive effect as it will allow your options to expire worthless and to collect the credit. If the underlying is below Strike B time decay is a negative effect as it will eat away at the long puts value.

Implied Volatility: An increase of implied volatility will be a positive effect on this play. It will increase the value of your options plus it will set your play up for a big move which is what you want

Notes: None at this time

Featured in Trade Review: None at this time

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Each year I like to take a moment to reflect on my swing trading from the prior year. The 2025 trading year offered a lot to be happy about, but it also changed my views in a number of ways and gave me some lessons to take from it, as well as some new perspectives to take into 2026 as I navigate the stock market for yet another year. I'm hoping this moment of reflection in this podcast episode will be as beneficial for you as it was for me in making it.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.