Had a few minutes tonight to some scans and look a few charts. Here are two stocks that I will be keeping a close eye on tomorrow should this unrelenting market melt-up continue. I would normally consider DO ( Diamond Offshore ) as a breakout swing trade, but given the markets current overbought conditions, I am only willing to hold my short setups (LSI and PKD ) overnight.

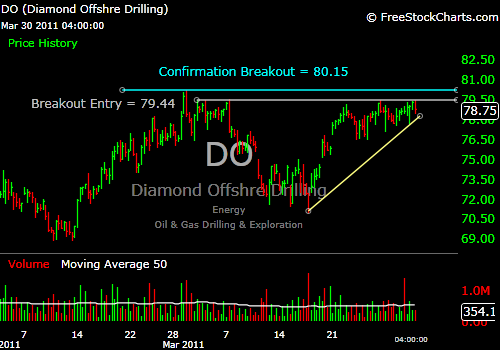

DO – Diamond Offshore

Really like this as a breakout play. It has a tight consolidation just below the resistance level. Ideally this stock will trigger at 79.44 on the back of oil strength and an rallying market. A confirmation of the breakout would be if “DO” was able to break 80.15 and close above that. Only then would I be willing to hold this stock overnight…(maybe!). If this stock does trigger my stop will be at yesterdays close ( 78.75 ) or the LOD ( Low of the Day )…whichever is greater.

ALTH – Allos Therapeutics

Another breakout play. This is purely a DAY TRADE. Do not be tempted to turn this into swing trade, or an investment!!! Based on its close today ( strength into the bell and volume ), this could easily breakout out in the 1st hour of trading should the market rally. I like this type breakout because because you get a two for one. One being the breakout above recent resistance at 3.13 and two being that it breaks past support ( which is now future resistance ) that existed the last week of February and the 1st few days of March. If this trade triggers, my stop will be placed at yesterdays close ( 3.08 ) or the LOD, whichever is greater.

Note…if you decide to trade this, watch the intraday volume closely. If the volume starts to dry up significantly, then cut the trade short and take profits if you have them.

If either of these trade triggers, and you are discipline with the stops, then both of these trades are low risk, potentially high reward $$ day trades.