Here are some possible swing trades I am watching. Swing trades, for me, are trades that can have a portfolio duration of as little as a week, to a much as a few months. I enter the positions after 1.) I have filtered ( screen ) based on fundamentals, 2.) Have analyze the Chart for solid Technical Patterns. I will usually remain in these positions until the technicals give me a reason to sell or they have reached a price target.

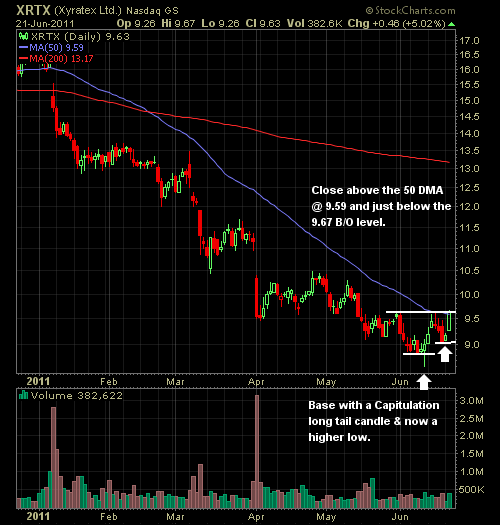

XRTX – Fundamental highlights – No Debt, P/E below 6, Cash Per Share of approx $4, EPS estimate @ 1.59 next year. XRTX has sold of significantly after a less than bullish forecast on their January and April earnings conf. calls, although both quarters they delivered strong results. At this point this trade becomes a value ( potential buyout target ) and growth play with technicals to support an recovery bounce from these levels. Target $10.75-$ 11.

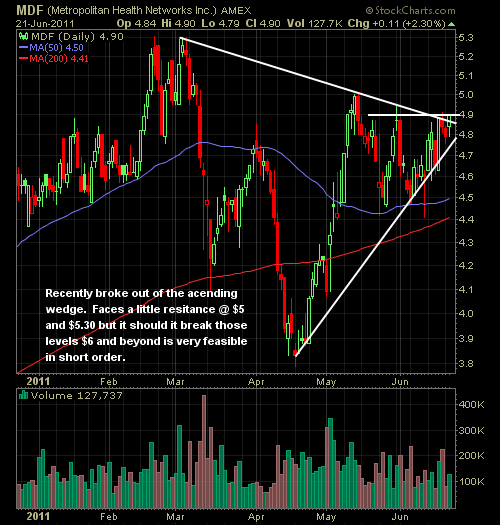

MDF – Fundamental Highlights – Small Cap profitable. 2011 EPS est. $.80!! Sales growth of + 15%, low Debt with Debt/Eg = .01, Approx 1.20 Cash/sh. MDF has also just announced plans to repurchase 25 million shares of its common stock on the open market. Target $6.

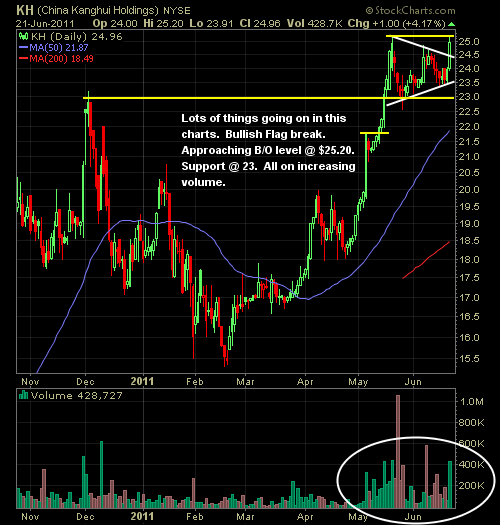

KH – Not a Pure Chinese Play as you might think at first glance. They have a substantial diversified international revenue base. No Debt, approx $3 cash/sh, and Earnings expected to grow at +25% for next 5 years. They are positioned internationally in the fast growing specialty medical instruments area. According to their CEO “We are experiencing significant growth across all product segments and all markets, driven by the solid uptake of our spine products and robust international sales”

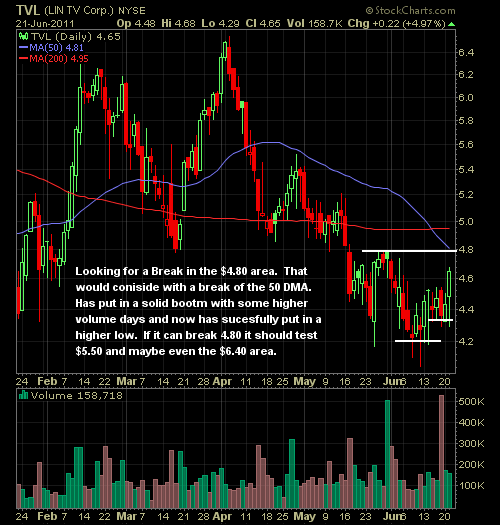

TVL – Profitable with PE approx 7, EPS growth appox 10%, Cash/sh = .50. TVL becomes an interest play as they are in the process of converting to a hybrid digital media outlet. In the 2 years since the launch of this initiative their Digital Revenues have gone from 0 to appox 20% of total revenue. Forecast Digital Revenue growth is expected to exceed 30%/yr. What also makes this interesting is that HULU.com has recently receive a private buyout offer. Speculation could drive money in TVL as they are in the process of aligning part of their business model with that of HULU’s.

APRI – High Flyer, Small Cap Bio-Tech -Expected to be profitable next year. Sales growth of approx 20% of past 5 years. Insiders have increase their percentage of ownership from 3% of total outstanding shares to 10% in the past year. According to their CEO ” “Our current cash reserves should take us to the second half of 2012. We also expect to be cash flow positive by the end of 2011.” Further, he points out, the Company’s first drug, Vitaros(R) for erectile dysfunction, is FDA approved and is very close to market, with a 12 product-candidate pipeline behind it.”

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

What do you do when the best trade setup that you can find is a stock that you already have a position in? Should you trade a stock that you already have a position in and exponentially increase the size of that position? In this podcast episode Ryan explains the circumstances that allows you to increase your position size in an already profitable trade and how to manage the risk in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.