Swing Trading with Ryan Mallory

SharePlanner Reversal Indicator: Fighting Sleep

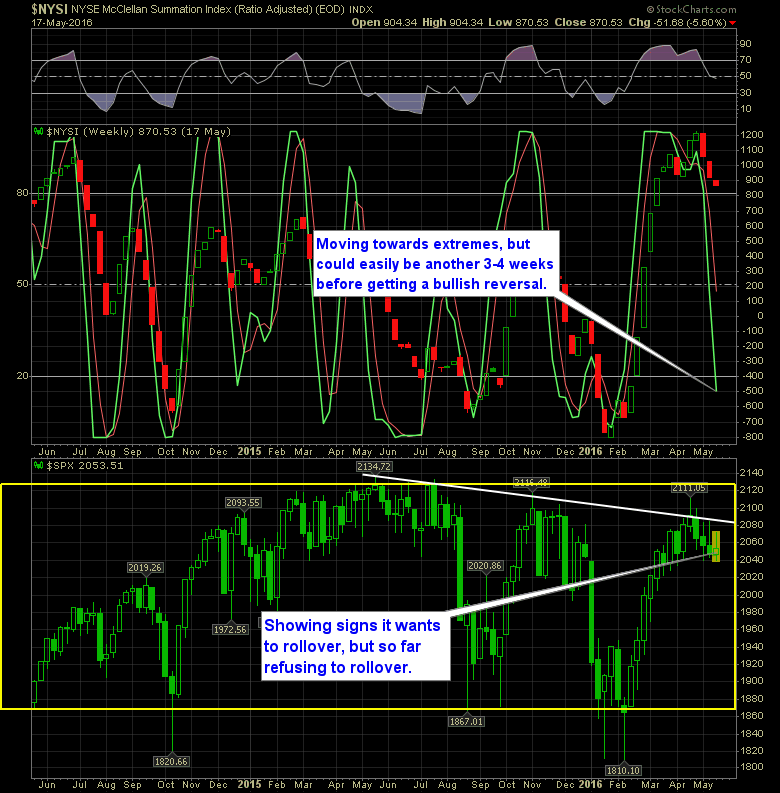

It is like the toddler who is pitching a fit and won't go to bed but can't manage to keep his eyes open either. That is what we are dealing with in this market - it won't allow itself to sell-off but can't find the momentum either to push price [...]