Corrections are 10% pull backs, Recessions are 20% sell-offs.

So far the real estate sector has seen a decline of about 5%.

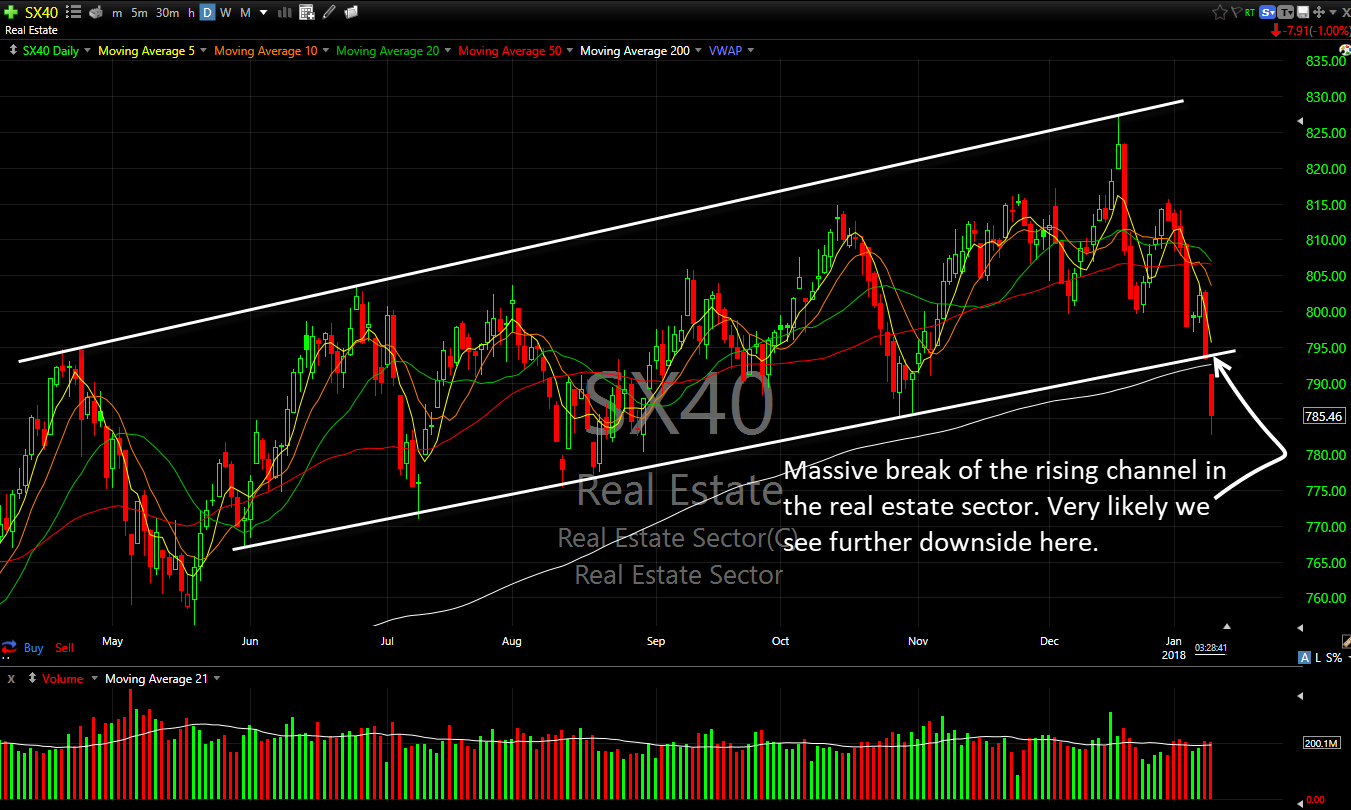

Normally I wouldn’t think to much about that, but there are a few things that I don’t like about the chart below:

- A perfectly formed rising channel that investors have had confidence in for a good while, has broken in a very big way, with a break away gap to the downside.

- There is a breach of a 200-day Moving average

- The fall is happening while the rest of the market (minus utilities) is experiencing incredible growth.

But now, residential stocks like Toll Brothers (TOL), DR Horton (DHI), Lennar (LEN) and Pulte Homes (PHM) are all trading at multi-year highs. But they are in the Consumer Cyclical Industry, which is, in fact very strong.

So what is driving this sell-off?

First you have the REITs just getting slammed (Real Estate Investment Trusts, for those who don’t know). Take Simon Property Group (SPG) – they have a $51B market cap and have seen a decline of about 30% since mid-2016. That makes sense though, considering all the closings we are seeing with traditional retail and the ghost towns that malls in general are becoming.

Second there is Public Storage (PSA). The name speaks for itself, and lets just say, it too, has seen brighter days – down about 30%.

But the biggest culprit are the Health Facilities like Ventas (VTR) and Welltower (HCN)

What’s the take away from all of this: Stay away from the real estate plays, unless your are dealing directly with the home builder stocks.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.