Strange how the market tends to repeat itself in a similar fashion time and time again. In this case, one doesn’t have to look back any further than earlier this year to see how the market is making a similar pattern to the inverse head & shoulders formation (IH&S) that we saw toward the beginning of the year.

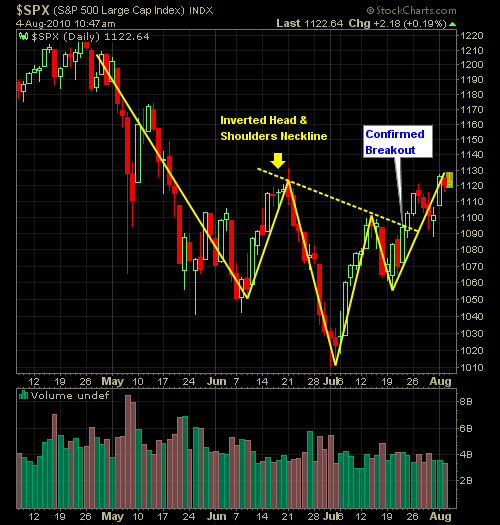

Here’s the S&P Now:

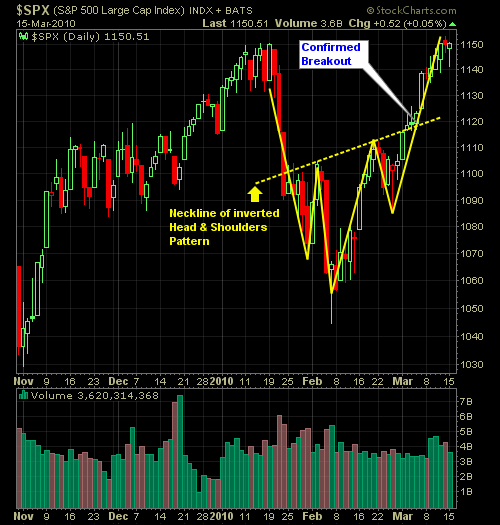

Here’s the S&P Then:

The crazy thing is, if this pattern is to play out similarly to the one we saw in January/February, we could be looking at new highs before the end of the year. With the mid-term elections rolling around, and the incumbents looking at getting taken to the woodshed, there definitely could be some incentive to push this market higher. One thing is for sure, and that is the bearish tones that I exhibited for the past couple of months have been put on the side-burner for now.