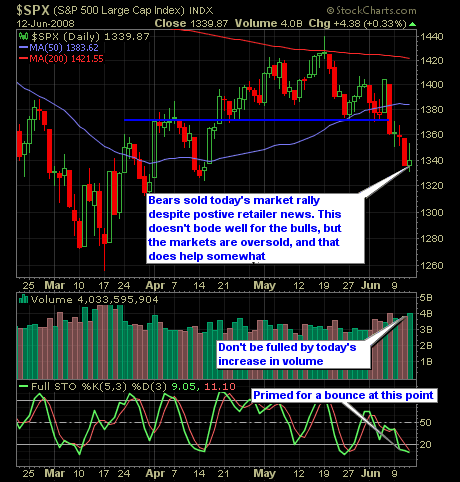

One of the best retail reports in six months, wasn’t enough to keep the markets up for the day’s entirety. In fact by the end of the day, the major indices found themselves in the red before rebounding in to the positive to close the day. It should be no coincidence either that oil happened to be climbing while the markets were falling. Oil is nearly the lone factor affecting the markets right now, as Wall Street has convinced themselves that as long as oil hangs around current price levels or higher, the market cannot move forward. So whatever your strategy is going forward, be sure to keep the aforementioned in mind and while we don’t recommend shorting oil at this point, when oil does come back down, it will come hard and fast, and unless there is another factor(s) affecting the market, stocks will rally.

Currently, the markets are extremely oversold and we don’t recommend going heavily short at this point, instead wait for a rally, as the bears have decided to ‘sell-the-rally’ which is the exact opposite of what the bears have been doing for the past couple of months, namely ‘buying-the-dip’.

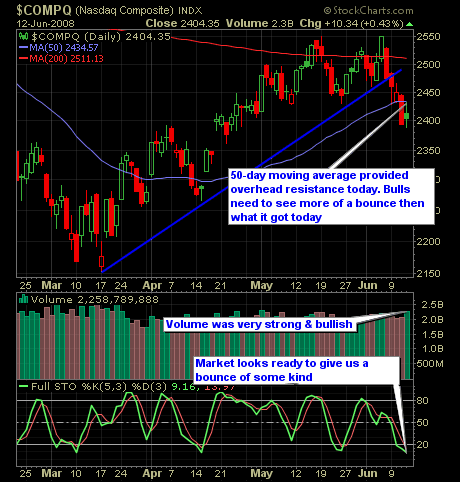

Here’s the NASDAQ and S&P Charts…