July 9, 2008

Here’s the leading sentence published by the AP, and tell me you haven’t heard this one about a zillion times in the past year: “Wall Street tumbled Wednesday as investors grappled with renewed worries about the soundness of the financial sector.” So are these worries “renewed” or are they really just “sustained”. We believe the latter. Investors aren’t suddenly getting nervous again about financials, they have always been nervous, and along with oil, is the reason why the markets are constantly tanking. The pressures are building day by day and not merely “renewing”. We are not forecasting a doomsday scenario, but the bears will continue to short every opportunity possible and yesterday was an excellent opportunity. Where I went wrong was believing that we would get another day of follow through setting up a solid, would-be shorting opportunity but instead we got a major sell-off. The bears are moving fast and if you want to make money to the short side you have to be aggressive with your entry prices

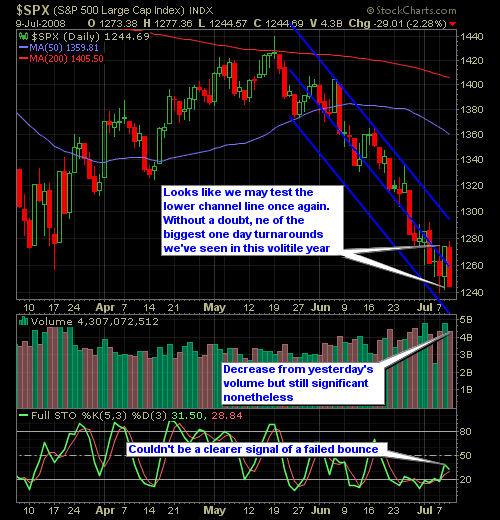

The Dow looks really bad, namely because of the heavy presence of financials. A break of the lows could provide an ideal shorting opportunity of the index. S&P in the near term doesn’t carry a descent enough of a reward for the risk. Major support is nearby at the lows from July ’06; believe it or not that is how far we have dropped in the grand scheme of things.

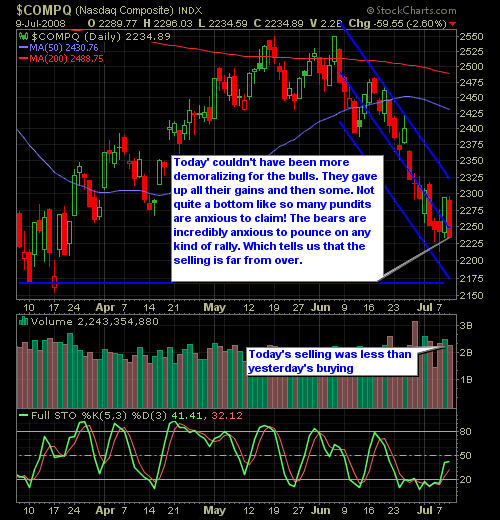

Here’s the NASDAQ and S&P Charts…

A word to the beginning investor and trader

Starting off this couldn’t be a better opportunity for you to come to grips with the unforgiving nature of the stock market. There is no free lunch, no “get-rich” scheme and no holy-grail trading formula that will make you riches. Those who started trading in the 90’s with the run-up in the NASDAQ thought the markets were easy and effortless, only to come to the realization in March of 2000 that everything earned can disappear in a blink of the eye.