There They Are

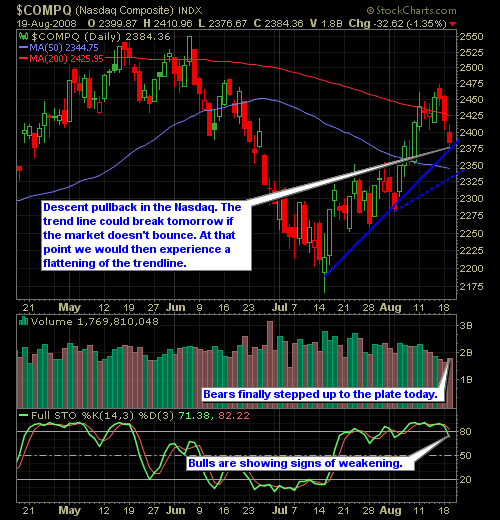

August 19, 2008 Yesterday it was asked exactly where was the volume to support the market’s recent selling. Today, the bears responded with a descent amount of volume as the broader markets sold off to the tune of about 1% on the day. You have a moron journalist at the [...]