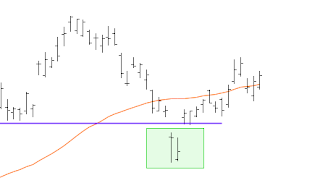

| Breakaway Gap |

Here we see a nice consolidation and finally the buying becomes strong enough to gap the price up. From there we see a nice run. This gap takes a non-trending stock and moves it to a trending stock. As a confirmation of the breakaway gap we want a nice spike in volume.

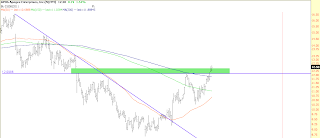

The island reversal is bit of a rare pattern so when it happens it makes a strong signal to trade on. A gap is created, it moves to sideways trading, and then it gaps in the other direction and continues to trend that direction. Lets show some examples:

|

| Island Reversal |

|

| Island Reversal |

|

| Island Reversal |

The thing to notice about the island reversal is that the second gap need to be in the same general area as the first gap. This creates a strong force back in the opposite direction of the first gap.

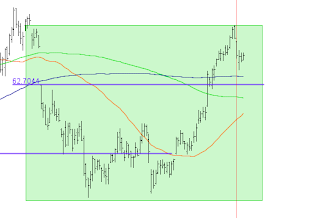

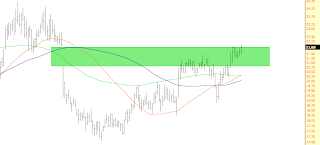

Gaps create a strong support/resistance points where the old price was and the new price is. These make for good entry points when they are broken and good exit points when they are hit. A big gap creates an area void of price action which allows the stock to move freely without in between with little resistance/support. There are a couple of ways to play these gaps. First you can play the gap in the opposite direction of the gap or when the gap is filling. Then you can play the gap when it has filled, or when it has reached the original price it gaped from. Here are some examples of both of these plays in action:

|

| Gap Filling |

|

| Gap Sell Off |

|

| Gap Fill & Sell Off |

|

| Gap Fill & Sell Off |

|

| Gap Sell Off |

As you can see gaps display pretty predictable price behavior. The allow for easy price entry, stop-losses, and target points. You may not always get a reversal after a gap fill but if you want to stay in the trade then remember to tighten your stop-losses or go ahead and scale out and take some profits off.

Don’t want to swing trade gaps? You can also day trade gaps, and there are several ways to accomplish this. You can go in the direction of the gap or you can fade the gap. If you go in the direction of the gap you look for a high or low to be put in and trade on a break of that price. If you wish to fade the gap, go in the opposite direction of the gap, then you want to put in a market order for the opposite direction of the gap.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Trading what you see and not what you think is one of Ryan's popular trading expressions that he has lived by in his 30 years of trading experience. In this podcast episode Ryan explains why it is so important to not think your way through the market but to be a trader who sees what to trade and reacts accordingly. If you are struggling as a trader, it may very well be that you aren't seeing but thinking your way through your swing trades.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.