I’m convinced that every day that Congress is in session, we lose more of our precious freedoms. To be completely honest, I know that there are a lot of people suffering out there financially and that these are perilous times, however, I’m almost glad the markets did not go up after the bailout was passed and signed into law. Had the market gone up it would have convinced those power-hungry politicians into thinking we needed them even more, when in fact, if they would just stay out of the picture all together, this mess would probably not have been as bad and the markets would probably have recovered by now.

In all seriousness who wants a market that says in order for it to work it has to have the support of the federal government? You might not want it, but if you support this bailout you are saying as much. We’ve allowed the SEC to ban short selling and that hasn’t worked, we’ve allowed the Fed to dramatically lower interest rates, we’ve allowed the federal government to bailout Bear Stearns, AIG, Fannie and Freddie, and that still hasn’t worked. And now….we want them to throw a $700B package to bailout the rest of them? Do they honestly believe that will work, and even if it does work, do we want it to be so because the federal government says so? No. It doesn’t end here either. They will want more oversight, more accountability standards, and if you thought Sarbanes-Oxley was an infringement, well then my friends you haven’t seen nothing yet.

I’m convinced we could have ripped the cover off of the Communist Manifesto today, stuck it in to the bailout (or whatever fancy “economic rescue” name they want to give it) and I bet the bill still would have passed. We’re losing our freedoms here – the ability to make and lose money; and most of America is okay with that, as long as the government doesn’t take too much money from their paycheck, so that they can still pay the cable bill and drink their six-pack. By supporting today’s bill we basically handed over to our government the responsibility of ensuring our financial future.

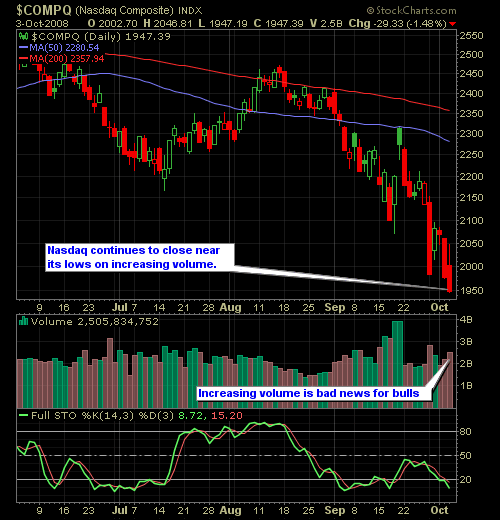

Alright – enough of that before I get a brain aneurism. I just needed to get that off of my chest. As for the actual charts, they continue to get worse, and the government needs to just step aside. The markets need to take their course and get it over with. Even if that means we experience 7000 or 8000 in the Dow. The sooner we can get a bottom the sooner we can finally move ahead.

As it stands right now, we are seeing more and more selling hitting the markets and if I was a gambling man, I would suspect that there will be a lot of people this weekend pondering their fates in the markets and when they see that their 401(k)’s have dropped over $200 or $300k on the year, they will have fresh memories of the Nasdaq and how they make a promise to themselves never to let a market collapse on them, and as a aresult they will probably pull the plug and move their capital to the sidelines. Just a thought….

Here’s the Nasdaq and S&P charts…

{easycomments}