Short Setups Currently In Play

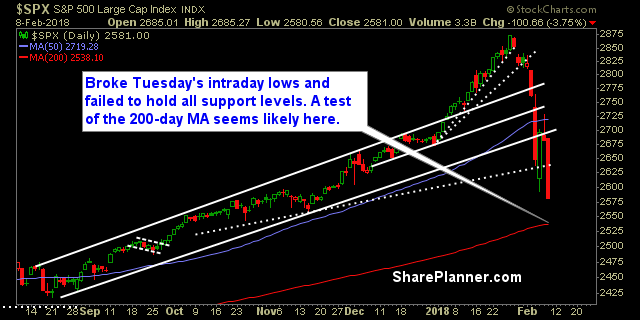

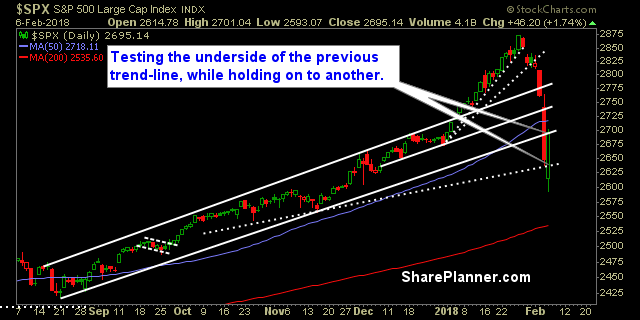

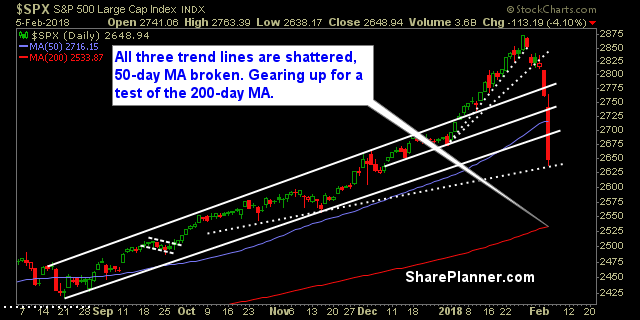

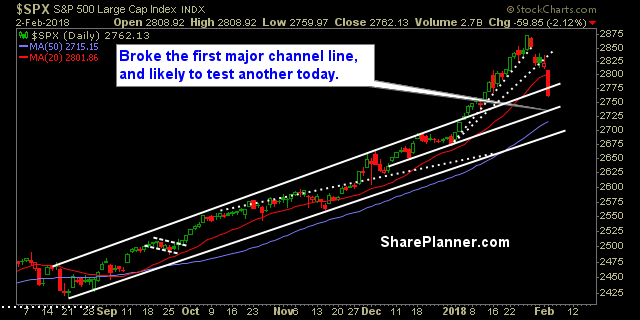

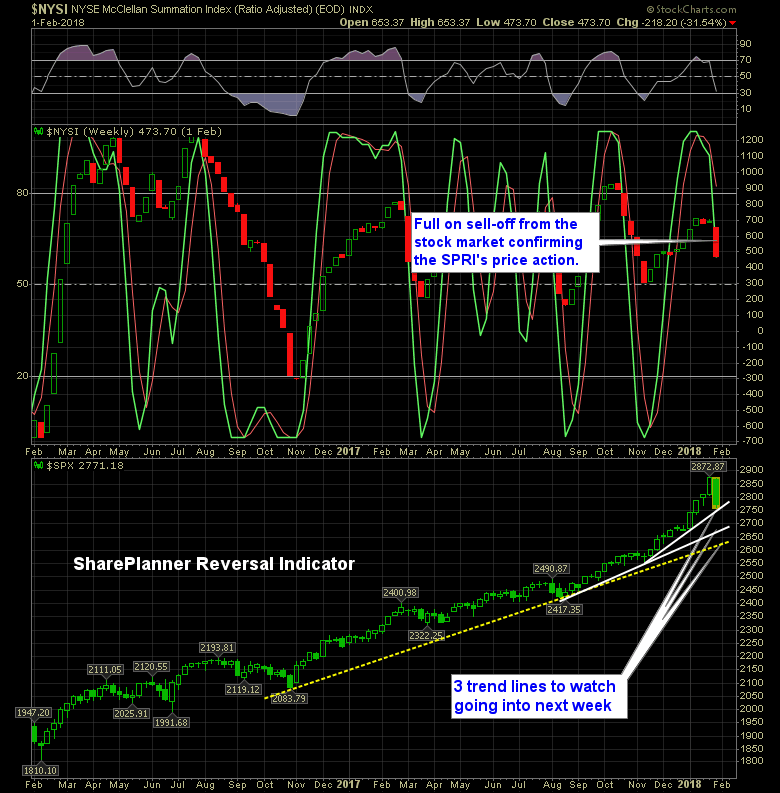

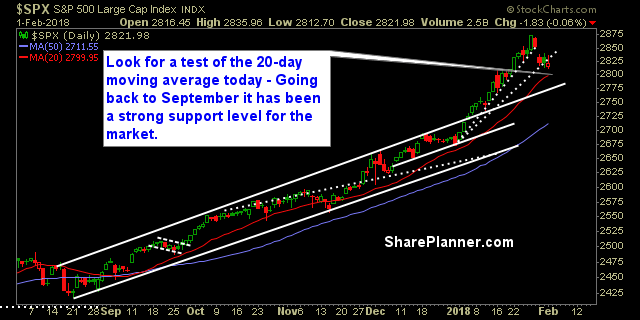

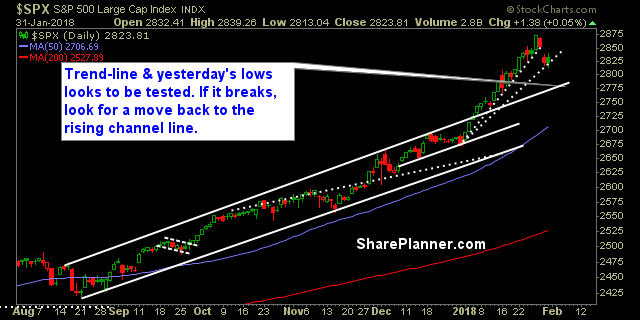

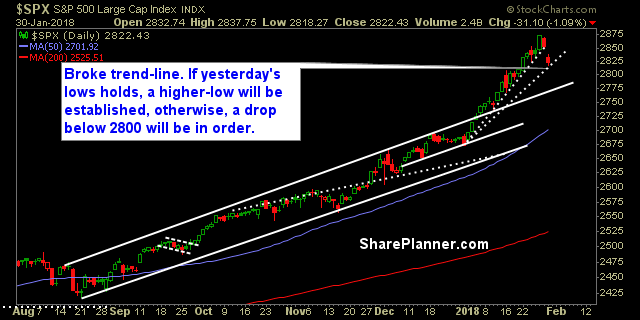

Stocks over the last couple of days have not looked all that healthy. As a result we are seeing intraday gains get wiped out in dramatic fashion and the while the market has bounced in a big way in the second half of the month, many of the stocks are [...]