Swing Trade Approach:

Busy day on Friday. I covered one of my short positions, Nutrien (NTR) at 44.39 for a 6.7% profit. Nice gain for a short position that I have held since November 26th at $47.60. But I didn’t stop there. I sadly closed out one of the more impressive trades of the year Visa (V), which was the final half position at 204.62 for a +11% profit. There was also the final half position in McDonalds (MCD) at 211.04 for a 6.3% profit. I also took the Advanced Micro Devices off the table at 50.13 for a +2% profit. Also worth mentioning that I also added one new long position and one new short position, and if the market weakness holds into tomorrows open, it is likely I will add a few more short positions.

Indicators

- Volatility Index (VIX) – VIX didn’t hold all of its gains, but it still managed to rally 12% to 14.56. Not a higher-high by any means but a push above 16.50 and things will get interesting.

- T2108 (% of stocks trading above their 40-day moving average): This indicator is deteriorating quickly and the fact that SPX is only 1% below its all-time highs, yet the T2108 has declined for five straight days, below its 200-day moving average and now sits at 52% is mind boggling, and indicates the strong potential for lower prices.

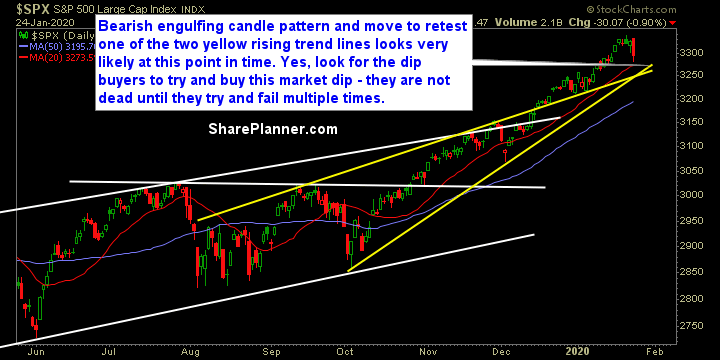

- Moving averages (SPX): Broke below the 5 and 10-day moving averages, and very likely a test of the 20-day MA will be seen tomorrow.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

The only sector to finish in the green yesterday was Utilities, while Healthcare was the big loser on the day. Energy continues to highlight the worst of all the sectors, declining for a fifth straight day. Materials have formed a double top that you should be concerned with. Financials breaking to the downside and out of its consolidation.

My Market Sentiment

The market has a big test ahead of it. With futs dipping substantially lower on a market contrived crisis (for the market, not for the world outside of the market – there is a difference), the bulls will have there chance today to decide whether it wants to buy the dip on a substantial two-day move lower. Within just a couple of days, much of the market’s profits on the month has been wiped out. If the bulls are going to pop back in, it will need to do so now.