My Swing Trading Strategy

One additional long position added yesterday. I took a stab at a short position as well, but that was determined to not be a great idea, rather quickly, so I closed the trade for a small loss.

Indicators

- Volatility Index (VIX) – Just can’t seem to gain any momentum, especially when volume is below average on the indices.

- T2108 (% of stocks trading above their 40-day moving average): Breadth was poor yesterday, as the market really didn’t move one direction or the other. In fact, the Dow had its best “down-day” ever, of only -0.0003%. The indicator saw a drop of 3.1% down to 59%. It concerns me how many stocks are struggling to participate in this rally. If they were to participate, there is plenty more upside for this market going forward.

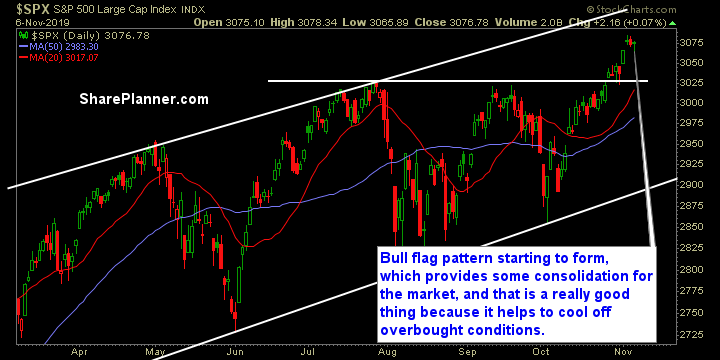

- Moving averages (SPX): Trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

The sectors that led yesterday were your safe sectors like Staples, Utilities and Real Estate. Energy finally saw some give back yesterday, representing much of the market’s losses, down 1.6%. Very little weakness elsewhere in the market, as most simply consolidated their recent gains. Financials, I’d be weary of at these levels. Historically speaking they are notorious for being sketchy, and at this point they are hitting extreme overbought levels, having seen very little in the way of a pullback in over a month.

My Market Sentiment

Little to no panic selling, the TICKS are muted, and breadth doesn’t show any signs of the tide changing against the bulls here. The one concern I have is a rug pull in the US/China trade negotiations. Price is factoring a lot of good news,and if a breakdown in talks were to occur, it would have a major ripple effect throughout the market.

- 4 Long Positions