My Swing Trading Strategy

I closed out my Long position SPXU (Inverse 3:1 ETF of SPX) yesterday for a +3.2% profit. After that I added three additional long positions to the portfolio. I will look to ride those three positions higher in the coming days, while being very selective about adding any additional long exposure.

Indicators

- Volatility Index (VIX) – Following an initial pop higher, VIX ran into declining resistance off of the August highs and immediately sold off 6.4% to close near the lows of the day. I suspect we’ll see a retest of 13 at this point, as it failed its breakout.

- T2108 (% of stocks trading above their 40-day moving average): Recovered much of the decline from the previous session with a 7% rally that took the indicator back up to 69%. Not a lot of room to run from here though – a move to 80% is possible, but probably not much more.

- Moving averages (SPX) Reclaimed the 20-day MA, but failed to break back above the 5 and 10-day moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology was back in the driver’s seat with a massive rally with Discretionary and Industrials right behind it. Very good sign for the bulls to have those three back at the top of the list. Safety stocks like Utilities saw some profit taking while Energy continues to languish.

My Market Sentiment

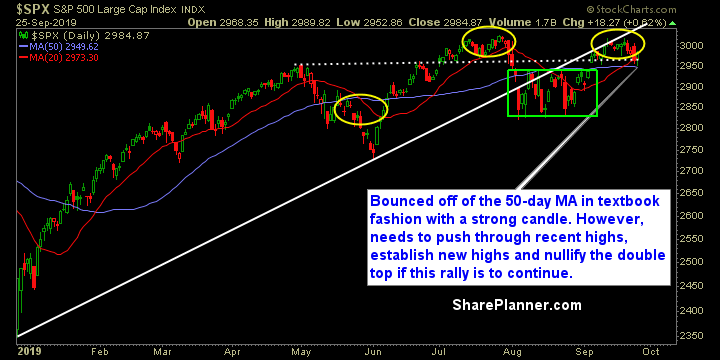

SPX bounced well off of the 50-day moving average, but the double top pattern is still in place and if this rally is to continue it needs to break recent highs and establish new all-time highs. Still plenty of headline risk out there.

Current Stock Trading Portfolio Balance

- 4 Long Positions.