My Swing Trading Strategy

I sold Twitter (TWTR) yesterday for a +2.4% profit. I still have one long position, but am looking to add a short position depending on the outcome of the Jackson Hole speech today. Staying light is the best approach to this market.

Indicators

- Volatility Index (VIX) – A 5.6% spike yesterday off of the 50-day moving average. Nothing major, but likely to see a big move today with China retaliating on the tariff front and Jackson Hole in the spotlight.

- T2108 (% of stocks trading above their 40-day moving average): A flat session, but ultimately, with all of its ups and downs, so were the indices. Current reading on T2108 is 39%.

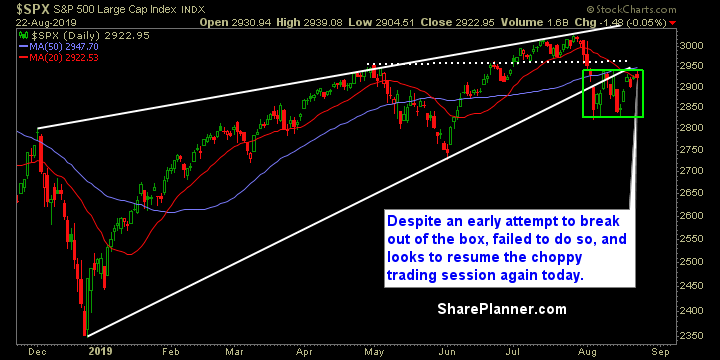

- Moving averages (SPX): Price closed fractionally above the 20-day moving average, while holding the 5-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Staples led the way yesterday followed by Real Estate and Financial Services. They were also the only three sectors that finished in the green. Energy has resumed its ways of being a huge detriment to the market as a whole and looks like it is coming out of a bear flag here. Financials is an absolute chop-fest.

My Market Sentiment

Expect some dramatic price swings today with Jackson Hole and unexpected trade war headlines. But regardless of the price action, nothing matters unless price is able to breakout of the three week box pattern.

Current Stock Trading Portfolio Balance

- 1 Long Positions.