My Swing Trading Strategy

I added one additional long position to the portfolio yesterday, while keeping the two positions that I came into the day with – both of which are showing sizable gains with solid rallies yesterday despite the market selling off. I am open to adding another long position today if the pre-market strength can hold hold up. I may also just sit on my hands and let my existing positions do the work for me.

Indicators

- Volatility Index (VIX) – A very minimal pop on the VIX of 3.7% considering SPX sold off 23 points. There wasn’t any real sense of panic in the sell off from yesterday.

- T2108 (% of stocks trading above their 40-day moving average): A 4.9% sell-off yesterday in the indicator yesterday put the reading at 36% at the close. Not a real sign of panic on the indicator. A reading of 15% or more would have made me much more concerned about the sell-off.

- Moving averages (SPX): No new developments on the moving averages. Finding resistance at the 20-day MA, should see a test of it once again today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Real Estate, Financials and Staples were the big market losers yesterday and the main culprits to the market sell-off. While Utilities showed the most strength, relatively speaking, right up there as well was Discretionary and Technology. I mention this because, any sell-off isn’t really legitimate unless the latter two are leading the way lower.

My Market Sentiment

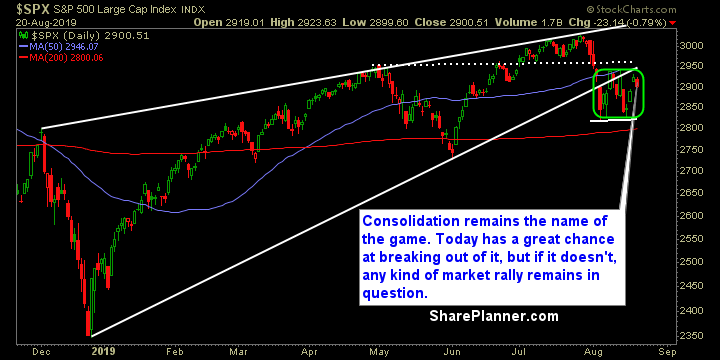

Solid market bounce coming into the day, following yesterday’s sizable decline across all the indices. We are still in this choppy range where price can’t seem to do anything at all to establish a new trend going forward in either direction. Until price is able to break out of the green box shown below, any market strength cannot be taken serious.

Current Stock Trading Portfolio Balance

- 3 Long Positions.