My Swing Trading Strategy

I have been playing more conservative ahead of the FOMC Statement Today, I have long and short positions to give my portfolio a more “neutral” balance to it. Depending on how the market reacts to the Fed and its interest rate cut, will determine how I trade going forward. For now, I will be holding off adding anything else until after the statement comes out.

Indicators

- Volatility Index (VIX) – A very decisive close above the declining trend-line from the May highs. It will be key for the VIX to follow through today, and not give it all back as it did on the previous break of the uptrend, the following day. VIX could see a huge day today, if the market has a strong negative reaction to the FOMC.

- T2108 (% of stocks trading above their 40-day moving average): Moved 4% yesterday to 63%. Resistance is overhead at 68%, as it has been unable to break through it since mid-February.

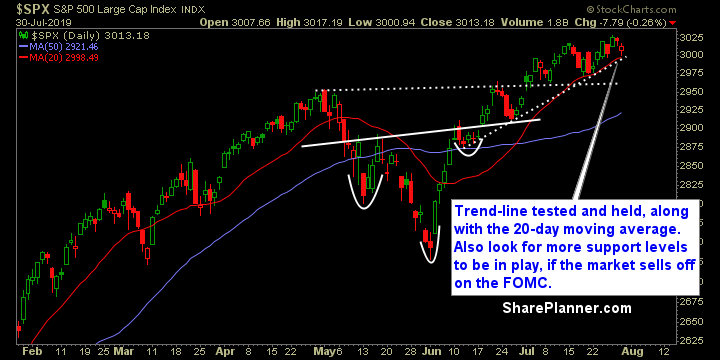

- Moving averages (SPX): Broke back below the 5-day moving average, and tested the 10 and 20-day MA’s and held them both. All three MA’s should see a test today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy saw a huge lift yesterday and pushed the market off its lows. Outside of that sector, your big leaders in 2019, including Discretionary, Technology, and Utilities, all saw major amounts of selling. Today, watch Technology, as it attempts to rally off of the Apple (AAPL) earnings from yesterday afternoon.

My Market Sentiment

SPX Short-term rising trend-line is in play once again today. Yesterday it was tested and held strong, along with the 20-day moving average. The lack of low volume tends to favor the bulls, but today, we could see a lot of volume pour in, and in the past that has bode very well for the bears.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 long positions, 1 short position.