My Swing Trading Strategy

No trades from me yesterday, and will look to increase stops and book gains in places where it makes sense today. Tomorrow the market is closed and I suspect today, barring any major market news or a bombshell in the Mueller report, that the volume will be low and price action uneventful.

Indicators

- Volatility Index (VIX) – Almost broke 11 surprisingly at yesterday’s open, but quickly rallied back to finish 3.5% higher on the day at 12.60. Could see further upside here .

- T2108 (% of stocks trading above their 40-day moving average): Third straight day of declines for this indicator with a 4% move to finish at 59%. Again, the market price action along with what is being seen in indicators doesn’t bode well for any major moves to the upside. But the bears still lack the ability to make a meaningful move lower.

- Moving averages (SPX): Broke back below the 5-day mvoing average but still currently trading above all other major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Healthcare was the drag on the market yesterday with a huge 3.1% pullback that dragged everything down with it. Stay away from this sector as it is extremely toxic and problematic at this point. Discretionary led the way with minimal gains but still one of the three strongest sectors out there along with Staples and Technology.

My Market Sentiment

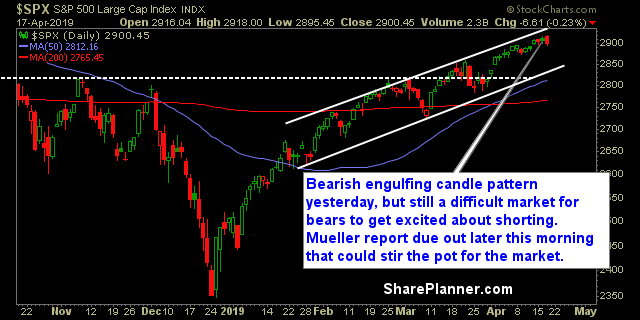

SPX trading at its rally highs, but not doing much over the last three days to inspire confidence in the bulls wanting higher prices. Instead it appears content with simply trading sideways while providing little clues as to where it want to ultimately go next.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 50% Long.