My Swing Trading Approach

I didn’t add any new positions yesterday, and as long as the market is able to hold things together, despite pre-market weakness, I’ll probably use today’s weakness to add another long position.

Indicators

- Volatility Index (VIX) – Finally a bullish candle on the VIX yesterday, with a pop of 2.4%, despite the market also moving higher. The VIX is looking for a reason to pop here in oversold conditions.

- T2108 (% of stocks trading above their 40-day moving average): It is bizarre to me how much of a move the T2108 has made without the slightest pullback. Goes well beyond a dead cat bounce. Current reading of 62%!

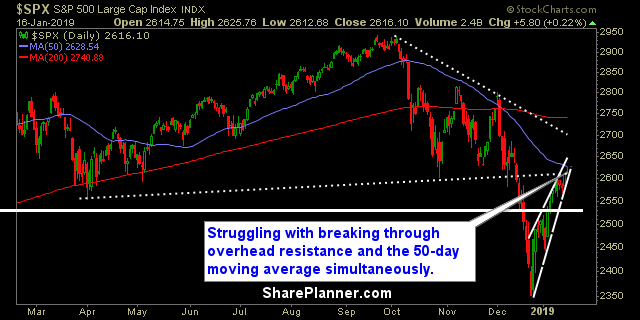

- Moving averages (SPX): Tested the 50-day moving average yesterday, but failed. In order to avoid a meltdown like last time, will need to break through that level today or tomorrow to keep the confidence of the bulls.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Financials rallied incredibly well on the coattails of Goldman Sachs (GS) and Bank of America (BAC). Materials sporting a nice bull flag. Discretionary, not sporting the best chart, as it still shows lower-lows and lower-highs.

My Market Sentiment

The 50-day moving average and the resistance overhead is creating a struggle for price here. Seeing a lot of individual stocks struggling with the same thing, and in some cases the 200-day moving average.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% Long.