My Swing Trading Approach

I closed out my Short Inverse ETF in SPXU for a loss yesterday, but early on, added Amazon (AMZN) and Square (SQ) to the portfolio. Not sure if I’ll be adding anything else today, the market will have to jump back into rally mode for me to do so.

Indicators

- Volatility Index (VIX) – Not much willingness to bounce in the VIX, though it would seem logical here, that it is due for a sizable bounce at any time.

- T2108 (% of stocks trading above their 40-day moving average): A 12% move taking the indicator to 57% – its highest reading since 8/31, and before the whole sell-off started.

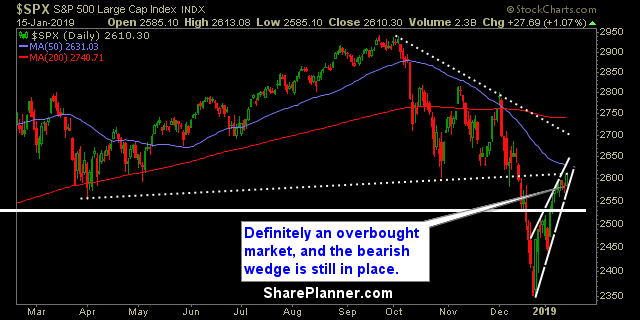

- Moving averages (SPX): Good chance we see a test of the 50-day moving average today, which is where the last dead-cat bounce stalled out at.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Heathcare rallied strong yesterday and was absolutely key for it to do so, as it was sporting a bearish kicker the day before. Technology, is coming out of a bull flag pattern here, and may want higher. Discretionary with a tight consolidating pattern – look for continuation higher.

My Market Sentiment

Despite some of the consolidation we have seen of late, following yesterday’s break out, the market remains in a very overbought state and needs to really push through the 50-day MA here, or see price action falter. That test should come today.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% Long.