Trading Notebook: $T $COIN $TLT $RIOT

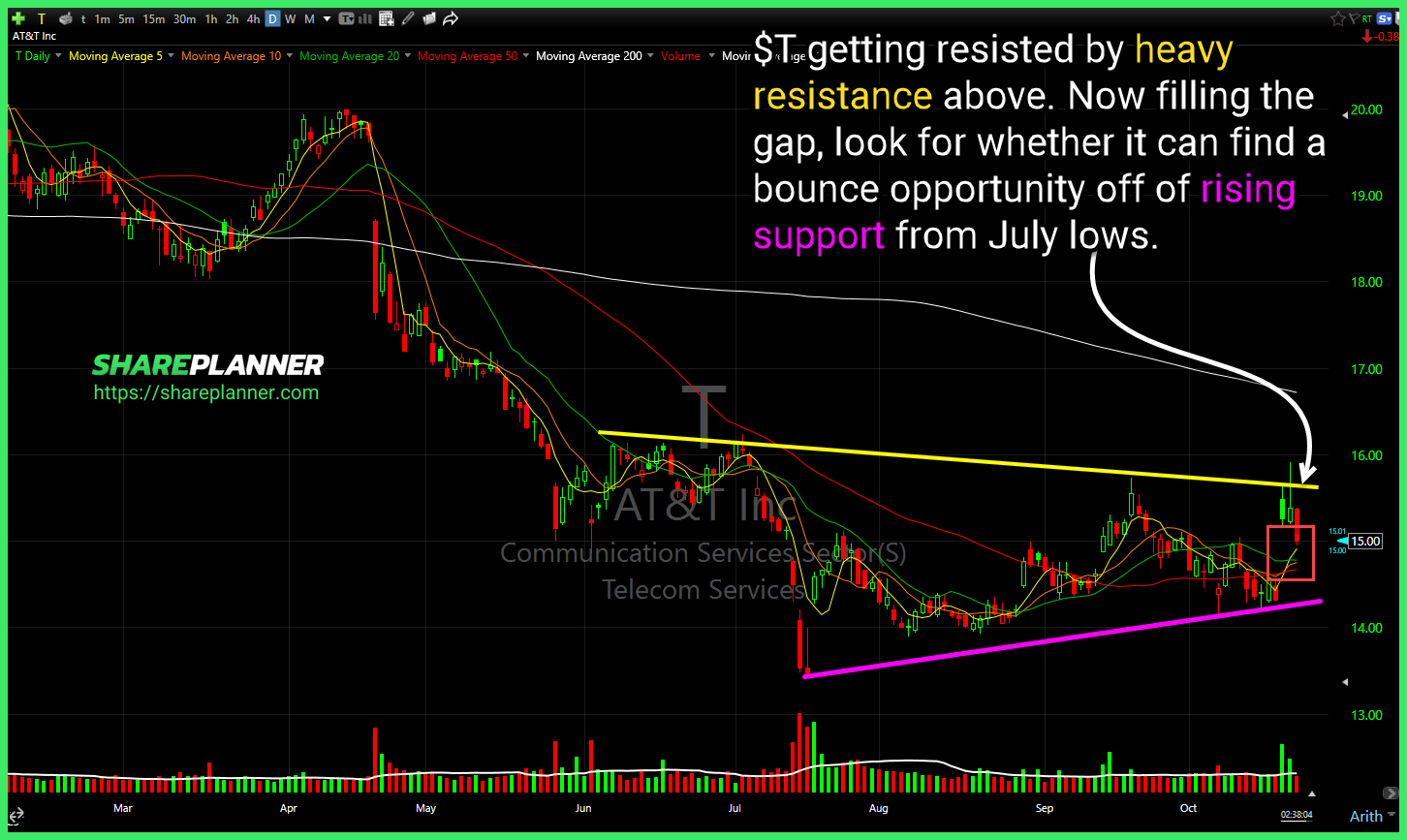

$T getting resisted by heavy resistance above. Now filling the gap, look for whether it can find a bounce opportunity off of rising support from July lows. $COIN nearing some important resistance here. Watch for a potential breakout, but extremely important that it closes above this level, and not just [...]