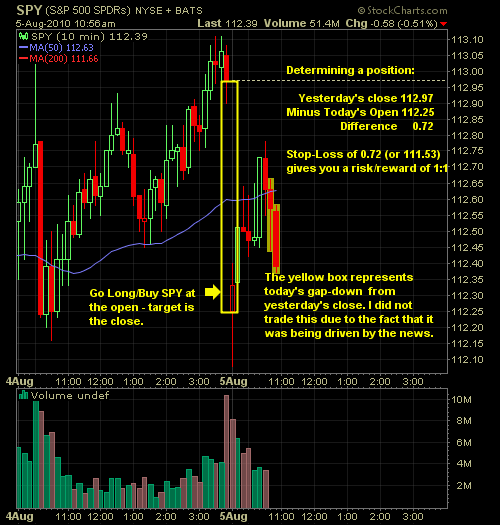

I’ve received quite a few emails and comments from folks asking about how I trade the gap (when I do) and how do I construct my trade. So I figured we could look at today’s open as a case study, even though I didn’t trade it this morning (we can talk about that too), what the parameters would have been had I gone through with the trade. I’ll try to highlight a few of these over the next couple of weeks, as well as look at some from recent weeks too.

As for now, here is how today’s gap worked.

As can see there are a few things to point out here…

1) Jobs report created a pretty big sell-off in the pre-market and scared me off from trading this one.

2) It is under 10 points on the S&P which I tend to only trade.

3) However, had I traded this, my stop-loss would have been the difference between yesterday’s close and today’s open, which is about .72 cents 1 Reward/Risk Ratio of 1:1.

4) I’ve been considering of late possibly making my stop-loss half of the opening gap, which would give me a 2:1 Reward to Risk ratio, which is very good, however, it would result in more stop-outs. But if I am right 33% of the time I break-even and since 80% of all gaps tend to fill, this would probably work out in my favor – still some research for me to do on this though before implementing it.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Trading what you see and not what you think is one of Ryan's popular trading expressions that he has lived by in his 30 years of trading experience. In this podcast episode Ryan explains why it is so important to not think your way through the market but to be a trader who sees what to trade and reacts accordingly. If you are struggling as a trader, it may very well be that you aren't seeing but thinking your way through your swing trades.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.