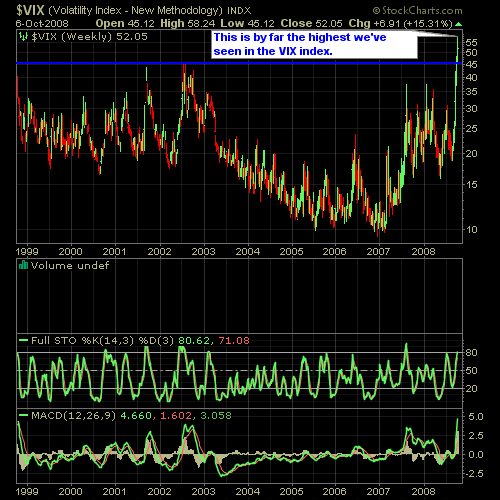

Here’s a couple of charts for you to take a look at. We are probably in the most oversold conditions that we have been in quite some time. Below is the VIX chart which measures implied volatility. It moves inversely to the market, so that it tends to spike when the market is declining. As you can see, that over the last 10 years this chart is at all-time highs.

A lot of traders will use this as a contrarian indicator and when you are getting readings over 55 it’s not a bad time to consider a contrarian trade – which is what we are providing our subscribers with today. Subscribe now and you can join the fun!

Another chart that we often provide our readers with is the S&P Moving Average Chart which also shows lows that haven’t been seen in a very long time. As you can see below, with all of the major declines we have seen this year, we are still hitting new lows on this reading.