The key to this market is to be aggressive with booking the profits to the short side. I have found that since the market bottomed out in 2009, the best approach to booking profits when short is to aim for profits of four to seven percent on each trade. When you try to ride a short setup for too long you run the risk of being caught in a massive short squeeze. And that is exactly what happened again today to the bears.

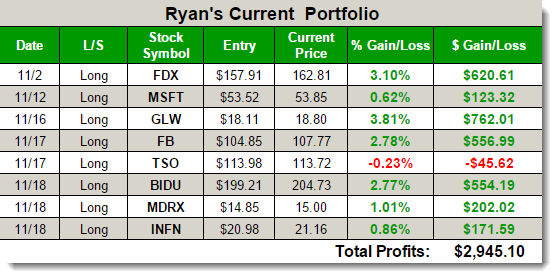

On the flip side, buying the recent dip from the November highs has been a good strategy so far and that can be seen most clearly by taking a look at my current portfolio in the SharePlanner Splash Zone:

As you can see, members of the Splash Zone are sporting some fancy profits, and as we enter the most favorable season for trading of the year, it is expected that this market will rally into the year end.

If you are interested in managing risk the right way, and learning what it means to profit consistently, then sign up for the SharePlanner Splash Zone and start swing-trading with me the right way. You can try it out for free for 7-days and see just what it is you are missing out on. If you are curious to just how well members of the Splash Zone have fared over the years, then check out my swing-trading past performance. Unlike all the trading charlatans out there, that refuse to provide traders with their past performance, I provide every single trade I have ever made in the Splash Zone over the years. My trading performance speaks for itself, and if you ready to start profiting then jump in the Splash Zone with me.

With The Splash Zone, you will get my low risk and high probability trade setups that no other trading service can offer.

Start Your Free 7-Day Trial Today!

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.