Pre-market update (updated 9am eastern):

- Europe is trading 0.4% higher.

- Asian markets traded 1.0% higher.

- US futures are slightly higher ahead of the opening bell.

Economic reports due out (all times are eastern): MBA Purchase Applications (7am), Housing Starts (8:30am), EIA Petroleum Status Report (10:30am)

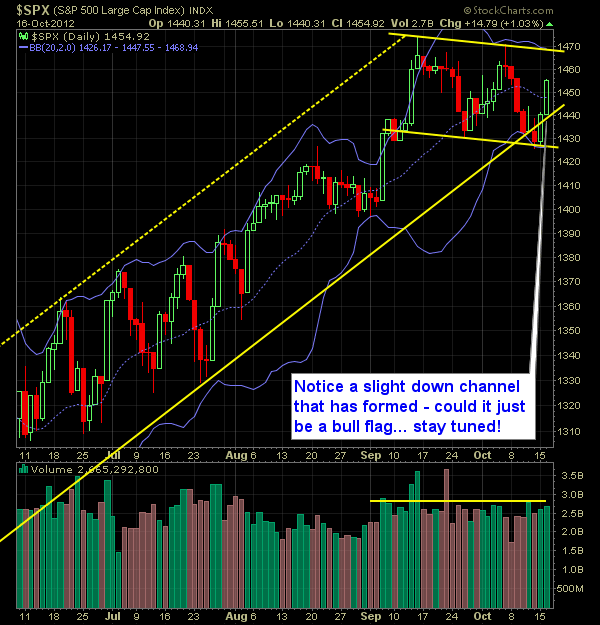

Technical Outlook (SPX):

- Solid continuation after the market yesterday, extend the market’s bounce to a second day.

- Multiple ways to look at this market… I’ll detail both perspectives

- Technically, we are in a downtrend. Since September highs, we have 1) formed a slightly lower-high 2) formed a subsequent lower-low

- This creates a SLIGHT downtrend, but the channel is barely trending lower.

- On the other hand, considering the larger uptrend that we are in from the 6/4 lows, one could consider this to be a developing bull-flag before moving higher.

- I’d recommend not drawing a conclusion on either scenario.

- Instead I’d wait for it to break out/down of the channel that has formed to determine ultimate market direction. Until then be nimble.

- SPX bounced perfectly off of the 50-day moving average and is set to challenge the 10 and 20-day moving averages as well.

- Any move to the upside should be considered a dead cat bounce. The only way this changes is if we can push and close above 1469.

- We confirmed the double-top pattern on SPX and closed below critical support at 1430 on Friday.

- Ultimately, we need to start focusing more on short opportunities particular on a dead cat bounce that takes price close to key resistance levels on individual equities, and offering ideal risk/reward setups.

- We have broken the long-term trend-line off of the 6/4 lows. That is no doubt problematic for bulls.

- VIX dropped back below 16.

- Fed’s QE3 launch is going to add a lot of buying power to this market and drive more people out of interest-bearing assets and into equities in search of some kind of return.

- One area of concern is the 3 large gaps off of the 6/4 lows that remain unfilled, including 6/6, 7/26, 8/3

My Opinions & Trades:

- Sold SHLD at $62.17 from $56.15 for a 10.7% gain.

- Sold LMCA at $110.99 from $107.00 for a 3.7%.

- Sold HAL at $34.39 from $34.17 for a 0.6% gain.

- Shorted BLL at $42.32.

- Bought MCD at $94.00.

- Remain long AAPL at $637.69.

- Remain short DRC at $52.38 and CPRT at 27.00

- Track my portfolio RealTime here.

Charts: