Pre-market update (updated 9:00am eastern):

- European markets are trading 0.4% lower.

- Asian markets traded 0.6% lower.

- US futures are slightly lower ahead of the bell.

Economic reports due out (all times are eastern): MBA Purchase Applications (7am), Consumer Price Index (8:30am), Empire State Manufacturing Survey (8:30am), Treasury International Capital (9am), Industrial Production (9:15am), Housing Market Index (10am), EIA Petroleum Status Report (10:30am)

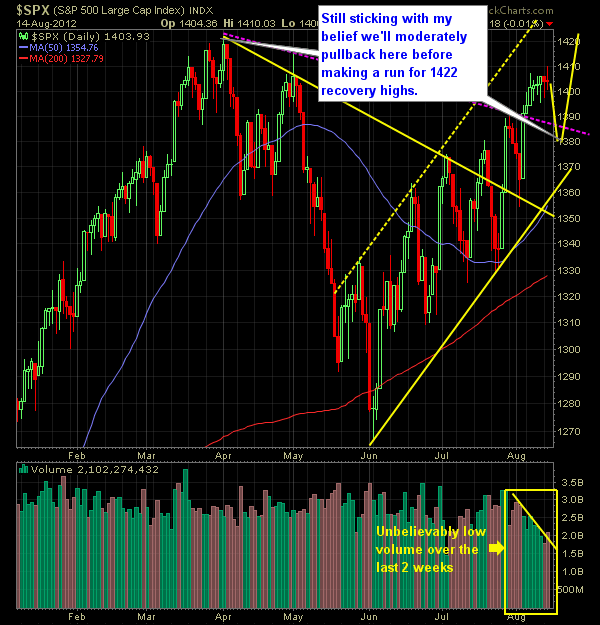

Technical Outlook (SPX):

- Despite trading higher for most of the day, the SPX succumbed to a late day sell-off that finished the market slightly in the red.

- Volume picked up some, but extremely low still.

- Last 3 days in the market has shown sideways consolidation and a bit of distribution, leading me to believe we’ll probably push lower in the coming days.

- Should a pullback occur, watch the 10-day moving average – its been a popular destination for bulls to reload at.

- Since the pullbacks off the 6/4 bottom, the pullbacks have ranged around 30-60 points each time, which would give us a range of 1380-50.

- Choppy action on the 30-minute chart over the past 7 trading sessions.

- Volume has become nearly obsolete and in line with holiday like volume. In fact volume has decreased 8 out of the last 10 sessions.

- Such low volume levels leads me to believe that we may be weakening under the surface and that the slightest bit of bad news accompanied with volume will trigger a stop-order raid on the bulls.

- The choppiness that has been a part of the trading action is due in large part to the low volume levels as well.

- Short-term we’ve actually slightly dipped below overbought levels.

- Next level for bulls to overtake is the 1422 recovery highs on the SPX.

- It’s not uncommon to see large market rallies going into an incumbent re-election.

- If you look at the 4 previous higher-highs in the market since the 6/4 bottom, then one could conclude that we’ve reached another temporary top, and are prime for another pullback.

- One area of concern is the 3 large gaps off of the 6/4 lows that remain unfilled, including 6/6, 7/26, 8/3

- At this point, uptrend support rests at 1358.

- SPX trading above all significant moving averages (10,20,50,200).

- VIX has moved below 15 for the first time since March but spiked noticeably higher yesterday (+8%)

- If another sell-off were to ensue, watch for a break and close below 1354 for a new lower-low in the market.

My Opinions & Trades:

- Day-Traded UEC yesterday and sold at 2.38 from 2.31 for a 3% gain.

- Sold OSK at $24.05 from $23.74 for a 0.31/share gain or +1.3%.

- Moved my stop-loss in MDT up to $39.61.

- Going to consider any sell-off as opportunities to buy stocks on the cheap. Dip buying should be the norm until a lower-low is put in place.

- Remain long AIG at $32.46, MDT at 38.15 and AMZN at $233.90. Short BRO at $25.65, HE at $28.45, COG at $42.01

- 3 longs and 3 shorts in my holdings is just a way for me to weather a pullback that I think should come here fairly soon.

Charts: