Pre-market update (updated 8:30am eastern):

- European markets are trading in a mixed fashion.

- Asian markets traded mixed/flat.

- US futures are trading break-even.

Economic reports due out (all times are eastern): None

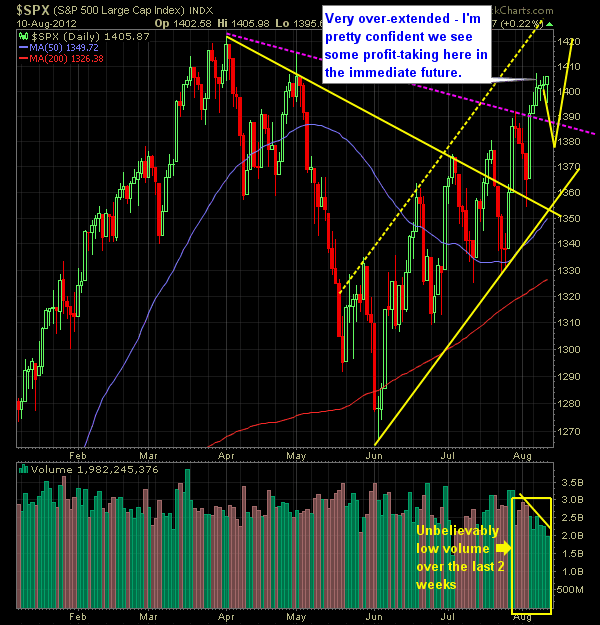

Technical Outlook (SPX):

- Late afternoon rally managed to lift the markets into positive territory for a sixth consecutive day.

- Volume, despite the strength in the market, is seeing holiday-like volume, which to put it plainly, is incredibly weird.

- We remain well-overbought on all time frames.

- If we were to rally for a 7th day in a row, it would be an event that hasn’t happened in years.

- Watch the 10-day moving average for minor support at 1390.

- The six-day rally the market is on, hasn’t occurred since 3/7-3/12.

- However, the gains that are being made are sluggish at best, and without much fanfare.

- Setting up for a pullback at the very least heading this week as buyers seem to be lacking conviction at these levels (just look at…yes…volume!)

- SPX poised to make a move to 1422 and challenge the year’s highs.

- It’s not uncommon to see large market rallies going into an incumbent re-election.

- 30-min chart has us primarily trading in a sideways channel.

- If you look at the 4 previous higher-highs in the market since the 6/4 bottom, then one could conclude that we’ve reached another temporary top, and are prime for another pullback.

- One area of concern is the 3 large gaps off of the 6/4 lows that remain unfilled, including 6/6, 7/26, 8/3

- At this point, uptrend support rests at 1355.

- SPX trading above all significant moving averages (10,20,50,200).

- VIX has moved below 15 for the first time since March.

- If another sell-off were to ensue, watch for a break and close below 1354 for a new lower-low in the market.

My Opinions & Trades:

- Bought EL at $55.07 on Friday

- Moved my stop-loss in MDT up to $39.61.

- Bought OSK at $23.74.

- Going to consider any sell-off as opportunities to buy stocks on the cheap. Dip buying should be the norm until a lower-low is put in place.

- Remain long OSK at $23.74, RHT at $56.19, AIG at $32.46, MDT at 38.15 and AMZN at $233.90. Short BRO at $25.65, HE at $28.45

Charts: