Technical Outlook:

- Despite an early sell-off, SPX managed to (surprise) buy the dip and rally the market higher to close out the day.

- FOMC Statement was released yesterday and there was no mention of a possible rate hike in June, leading investors to believe that it is not a live meeting, thereby rallying the market.

- Bank of Japan last night did not do enough to impress investors and as a result, spooked the market into a sell-off in the futures.

- USD/JPY has dropped nearly 3% following the BOJ news.

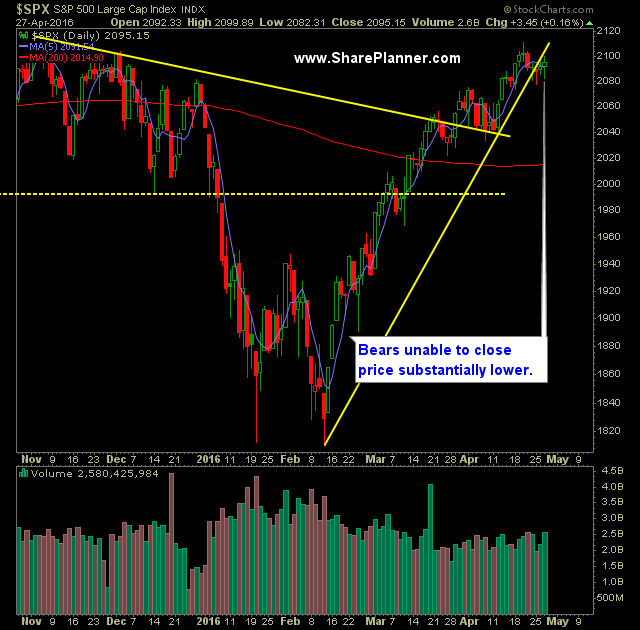

- Despite a 5/10 cross over on the moving averages, SPX managed to recapture both MA’s yesterday.

- A very slight increase in volume on SPY yesterday, but well below the average.

- Interestingly enough, SPY has not seen above average volume since February 11th – the day that the market bottomed from the sell-off.

- Head and shoulders pattern on SPX was significantly hampered following the FOMC Statement. It can still play out, but not as “picturesque” as it was heading into the day.

- VIX continues to struggle to break the down trend established off of the February highs. Tested the last three days and failed each time. Will be tested again today.

- A break below 2077 would break below the neckline of the 30 minute head and shoulders pattern.

- A break below 2073 would break below the lows of last week which hasn’t happened in the last 11 weeks now.

- Advancers have been incredibly strong of late despite weak or minimal moves from the market as a whole. This is a rare phenomenon.

- Today the FOMC Statement comes out at 2pm eastern. Don’t fall for the initial move that often results in a market head-fake.

- SPX has closed above the previous week’s lows for 11 straight weeks. The record is 13 weeks – as you can see, we are in some rare air here, and the likelihood that it persists isn’t very favorable.

- It is very important to be aware of the potential for a strong pullback here and to manage your long position risk accordingly.

- April has been bullish in nine of the last ten years.

- Yellen’s dovish outlook as it pertains to rate hikes has been, in large part, the reason for the massive rally off of the February lows.

My Trades:

- Added one new swing-trade to the portfolio.

- Currently 20% Short / 80% Cash

- Remain Long: SPXU at $27.67 (Bearish ETF)

- Will look to add 1-2 new short positions today if the market seeks to push lower. Will flip to the long side if price action can break out of the current trading range.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone