My Swing Trading Strategy

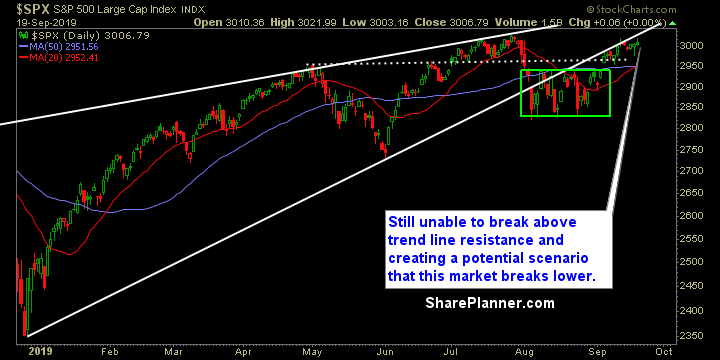

I booked profits in Square (SQ) yesterday at $59.01 for a +2.6% profit. Not as much as I would have liked, but it simply could not push and stay above the resistance at $60. I added two additional new trades yesterday as well including a short position on SPX.

Indicators

- Volatility Index (VIX) – Rallied off its lows for a 0.7% profit, and hovering above the 14 level. Yet to test the lows seen back in July and April of this year. VIX is trying to base at current levels here and could see a pop higher from here.

- T2108 (% of stocks trading above their 40-day moving average): Struggling over the last six trading sessions to see any real move higher. Breadth has been poor and most days the market is simply giving up its early morning gains. Currently at 70%.

- Moving averages (SPX) Currently trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

The continued theme this week has been strength in Utilities and Healthcare. The former of which has rallied the last four days and seven of the last eight. Energy saw its third straight day of selling following huge pop back on Monday. Very close to filling its gap from the oil bombing. Technology has been stagnant all week long, but could easily break higher from here. For a complete sector analysis, check out my latest post.

My Market Sentiment

Consolidation in the market over the last six trading sessions as intraday market strength continues to be weak in breadth and often times seeing a fade in the afternoon. Once the market starts trading at or near all-time highs, price action gets clumsy and is susceptible to downside risk. As was the case back in May and July.

Current Stock Trading Portfolio Balance

- 3 Long Positions, 1 Short Position.