My Swing Trading Approach

I took a position fading the market’s gap up yesterday and held it overnight. Ahead of tomorrow’s market closure, I suspect volume will be notably lower, and a willingness to continue pushing the market further into overbought conditions will prove difficult. I won’t be overly aggressive in either direction today, but will consider adding 1-2 new swing-trades to the portfolio today.

Indicators

- Volatility Index (VIX) – VIX dropped another 9% yesterday, and finished just above the 200-day moving average and above the 16 level and the November lows.

- T2108 (% of stocks trading above their 40-day moving average): An 11% rally yesterday pushed the T2108 up to 49. The highest such move since 9/21 and a breakout for the indicator.

- Moving averages (SPX): Broke the 50-day and 200-day moving averages before pulling back to the 50-day perfectly and bouncing yet again. Now trades above all the major moving averages for the first time since early October.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy had a huge bounce yesterday that led the market higher, but still in a well defined downtrend, and marginally off the recent lows. Materials developing a double bottom currently, but still, significant improvement is needed. Utilities hitting new all-time highs, and while Technology has had a solid run off of the November lows, the fact remains that it is still in the midst of a series of lower-lows and lower-highs.

My Market Sentiment

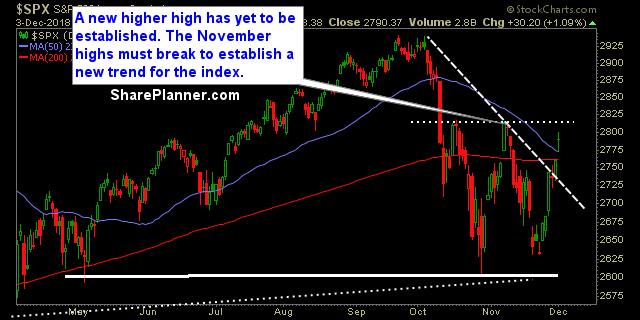

The market did little to nothing to increase its gains following its massive gap higher. Instead it formed a doji candle with a gap left to be filled below. Yesterday’s rally did not do enough to break through key resistance as shown below. Establishing a higher-high will be key to reversing the current trend of this market.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 short position.