My Swing Trading Approach

Yesterday I found myself day-trading the market again. Not the ideal situation, but considering the after hour news that hit with Trump and tariffs on China, it turned out to be a good decision. Two trades yesterday, both winners, with AMZN yielding +1.4%. I am open to playing the market in either direction today.

Indicators

- Volatility Index (VIX) – A 13% breakdown on the VIX indicator taking it down below 20 to 18.90. Watch for a pop back near the 20 area as futures are weak.

- T2108 (% of stocks trading above their 40-day moving average): Bull flag pattern on the T2108 confirmed yesterday and Looking to make a move back towards 40, if it can avoid the head-fake.

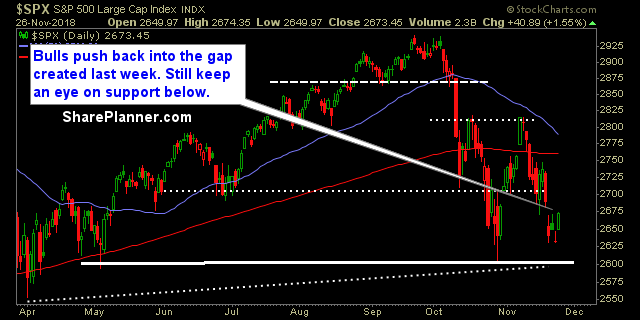

- Moving averages (SPX): Big rally yesterday, took price back above the 5-day moving average. Death cross of the 50/200-day moving average will likely happen in the coming weeks.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology picked up steam throughout the day, and led the market higher with Discretionary right behind it. Financials working a bull flag pattern. Energy’s rally yesterday was meager, gave up much of its gains on the day and shouldn’t be trusted as long as it remains and a solid downtrend. Utilities continues to trend higher. Materials continues to breakdown.

My Market Sentiment

Massive rally yesterday that threatens a reversal today at the open. Worth noting though that the gap down from last week was breached. The bulls over the lat two months does not have a great track record of maintaining rallies.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash.