My Swing Trading Approach

I took a day-trade in SPXU yesterday for a +4% profit, after I was knocked out of my two long positions at the open. Sitting in cash now, and would obviously like to still be in $SPXU, but I would simply be chasing it to get back in here. Also, with futures gapping down over 40 points here at the open – a true rarity, the market could be setting itself up for an emotional bottom put in place, that leads to a short-term buying opportunity.

Indicators

- Volatility Index (VIX) – VIX had a 10% move yesterday, and looking at another 11% at the open here to take it over 22 and looking at a break of the month’s highs.

- T2108 (% of stocks trading above their 40-day moving average): This is the most odd indicator of them all right now – it has yet to really break down. Still a bull flag, but I don’t trust it, not with the weakness that we are seeing at the open. I suspect this will break down dramatically.

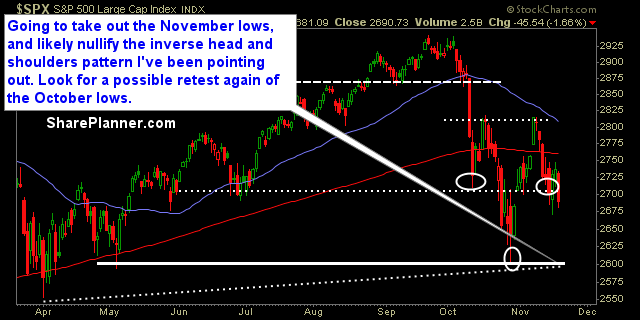

- Moving averages (SPX): Broke back below the 5 and 20-day moving averages yesterday, and now trading below all the major moving averages here.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities was the safe haven and pushing higher for a second straight day and by far the most bullish sector. Many of the sectors today will be taking out their November lows, and looking at a push towards their October lows. Technology is likely to take out its October lows at the open here.

My Market Sentiment

It is odd to me this heavy sell-off is happening during one of the most bullish trading weeks of the year historically, and during low-volume holiday week. With a gap down of over 40 points in store, look for a very dramatic flush at the open and a potential wipe out of prices that puts in a short-term bottom. No way to say for sure, but this certainly feels like Wall Street is panicking at the open here.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash.