My Swing Trading Approach

This has been a cautious week for me, especially due to the lack of continuity among the sectors on a day-to-day basis and the holiday right in the middle of the trading week. Once we get past the employment report this morning, and direction becomes better known, I may look to add a long or short position to the portfolio.

Indicators

- VIX – a 7.3% reversal here, and at the bottom side of a 7-day range. Watch for a break down here.

- T2108 (% of stocks trading above their 40-day moving average): Adding 10% on the current bounce and up four straight days. Broke through resistance at 56% and now at 57%.

- Moving averages (SPX): The 5, 10 and 50-day moving average have converged together, which price broke well above, and sets up to test the 20-day moving average now.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology back to leading the market – a really frustrating sector to trade over the last eight trading sessions, as it keeps rotating between being the market leader and laggard on a near daily basis. The same can be said about Financials and Energy. Staples starting to break out here following yesterday’s move. Real Estate continues to be the market’s strongest sector of late. Healthcare looking to take out June’s highs here.

My Market Sentiment

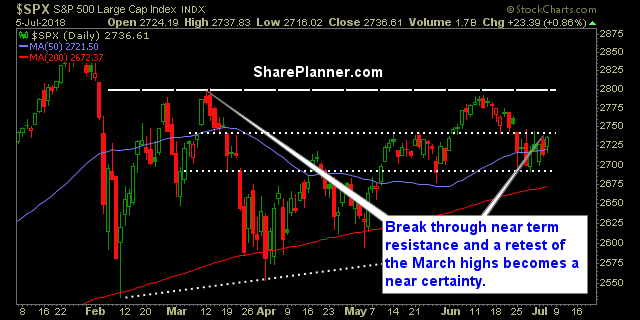

Yesterday was a vast improvement for the market, but depending on the outcome of the employment number this morning and the start of the trade war, will largely influence price action and determine whether price can ultimately break through short-term resistance shown below and on to the test of the March highs.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 4 Long Positions