My Swing Trading Approach

At this stage, I am quite happy with the stocks I have in the portfolio. I am looking to play it cautious here, as I do not want to stock pile too many positions here. I’ll raise my stop-loss on existing trades. With low volume market conditions, I’m not going to place too much trust in this market.

Indicators

- VIX – Down four of the last five trading sessions, following its spike last week over 18. Down over 30% since, and currently at 12.40. Watch for support at 12.29.

- T2108 (% of stocks trading below their 40-day moving average): The moves are meager here. Not much happening. Remains at 65%. Still needs energy and financials to participate for this indicator to overheat.

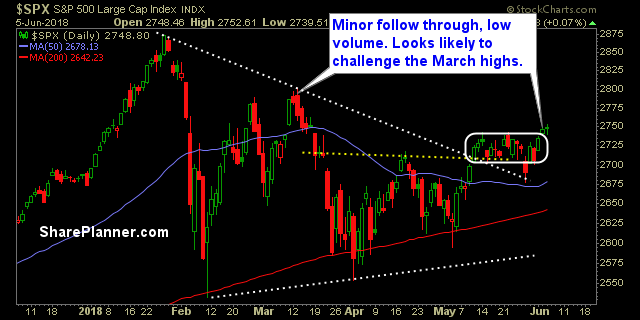

- Moving averages (SPX): Trading above all the major moving averages.

- RELATED: Patterns to Profits: Free Training Course

Industries to Watch Today

Technology still the market’s best sector and hitting new all-time highs. Discretionary is right behind it. These two sectors are your “Go-To” plays. Industrials and Healthcare are both showing signs of wanting to push higher in the short-term. Energy still problematic, and I’m not trusting Financials.

My Market Sentiment

The volume is extremely low, but support managed to hold up yesterday. I’m not expecting massive moves by the market at this point, but from a bullish standpoint (which is what I am here), I want to see the breakout from Monday to remain intact and continue acting as support.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 6 Long Positions