Inflection point: Let tech bust here or buy the dip once again.

That is the choice the market has because what we saw on Friday with everything tech related being sold in a frenzy, made it seem like that suddenly, no one wanted to be in anything Nasdaq or tech related. Heck, did you see Amazon? It had its very own flash crash! Dropping from $1,012/share all the way down to $927 and bouncing instantly back up to where it closed at $978.

Traders became suddenly suspicious of stocks, but on the other hand, while the Nasdaq got wasted, the financial stocks and everything else that was considered non-tech, i.e. Walmart (WMT) Caterpillar (CAT), and all the banks, managed to rally on the day.

And small caps? They managed to do alright too.

Nonetheless, the VIX was up over 12 at one point and finished 5.3% higher, while the T2108 (the % of stocks trading above their 40-day moving average) managed to rally 12.5% on the day.

Explain that!

Really what we have to do is see how the market wants to respond today. In the premarket equities look weaker but what has been seen over the past year is that all the hard sell-offs are pretty much contained to just one day. If that is going to be the case here, then the market will have to rally once again today.

Meanwhile – I sold a lot of stocks on Friday – most due to raising the stop-loss but others like Cypress (CY), I noticed early on wasn’t right in the head, and I decided to dump it at $14.08 instead of waiting for its stop to trigger at $13.71, which would have been hit later on that day had I not sold out early on. But that was really the only negative return on the day, as I closed out trades in RACE for +6.3%, Amazon +3.8% and AAL at +2.9%. So overall, it was a day of booking profits, and heading into today I have a rather neutral portfolio ahead of the market open and I’ll wait to see which direction this market ultimately wants to take me.

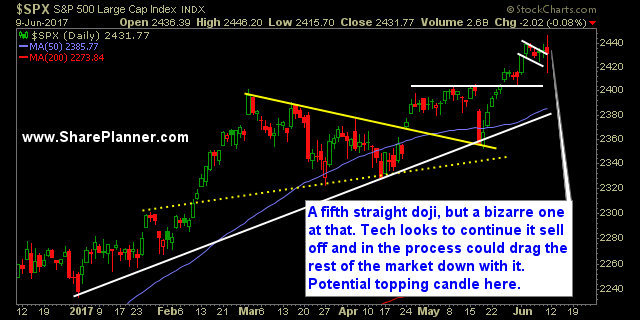

S&P 500 Chart

Current Stock Trading Portfolio Balance:

- 2 Long Positions, 1 Short Position

Recent Stock Trade Notables:

- Ferrari (RACE): Long at $84.60, closed at $89.93 for a 6.3% profit.

- Amazon (AMZN): Long at $964.70, closed at $1001.23 for a 3.8% profit.

- Cypress Semiconductor: Long at $14.20, closed at $14.08 for a 0.8% loss.

- American Airlines (AAL): Long at $49.18, closed at $50.62 for a 2.9% profit

- Verisign (VRSN): Long at $91.35, closed at $91.71 for a 0.4% profit.

- Alibaba Group (BABA): Long at $124.95, closed at $137.51 for a 10.1% profit.

- Starbucks (SBUX): Long at $61.78, closed at $63.68 for a 3.1% profit.

- Western Digital (WDC): Long at $91.24, closed at $89.29 for a 2.1% loss.

- Broadcom (AVGO): Long at $236.65, closed at $241.15 for a 2% profit.

- SPXU: Long at 16.60, closed at $16.98 for a 2.3% profit.

- JP Morgan Chase (JPM): Long at $87.84, closed at $85.98 for a 2.1% loss.

- Micron Technology (MU): Long at $29.00, closed at $28.04 for a 3.3% loss.

- Alibaba Group (BABA): Long at $116.25, closed at $124.09 for a 6.7% profit.

- Southwest Airlines (LUV): Long at $58.35, closed at 57.23 for a 1.9% loss.

- Broadcom (AVGO): Long at $223.63, closed at $228.65 for a 2.2% profit.

- Workday (WDAY): Long at 86.00, closed at 90.32 for a 5% profit.

- Univar (UNVR): Long at $30.96, closed at $32.20 for a 4% profit.

- Alibaba Group (BABA): Long at $111.91, closed at $115.48 for a 3.2% profit.

- Redhat (RHT): Long at $85.21, closed at $87.21 foor a 2.4% profit.

- Darling Ingredients (DAR): Long at $15.19, closed at $14.90 for a 1.9% loss.

- Apple (AAPL): Long at $143.82, closed at $147.11 for a 2.3% profit.

- Teradyne (TER): Long at $31.16, closed at $33.03 for a 6.0% profit.

- UPRO: Long at $92.75, closed at $94.78 for a 2.2% profit.