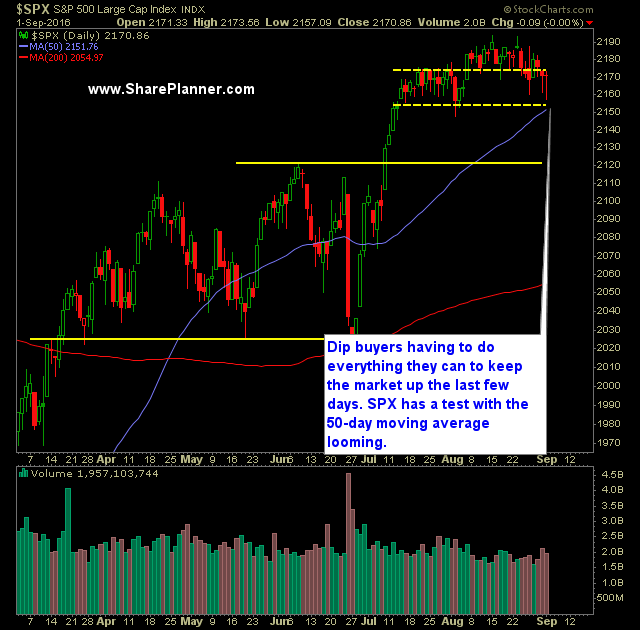

Technical Outlook:

- Another sell-off yesterday, another ramp into the close. This time the bulls wiped out 15 points in losses on S&P 500 (SPX) to close the day flat.

- As a trader, this is not the kind of market environment that you want where price simply reverts to the mean. You want trendlines and chart patterns. A flat, non-moving market is not ideal for trading opportunities.

- Employment Report came out this morning and was a solid miss, sending futures higher, the chances of a rate hike in September tumbling (from 36% to 22%).

- CBOE Volatility Index (VIX) continues to struggle holding any gains on the daily chart. Each time being victimized by the buyers of equities.

- SPDRs S&P 500 (SPY) volume increased substantially yesterday and for the second straight day. Above average reading.

- SPX still trading below the 5, 10 and 20-day moving averages.

- August was the first trading month that finished in the negative since February, ending a five month winning streak.

- United States Oil Fund (USO) looks to form the right shoulder of the head and shoulders pattern that I have been mentioning.

- Stocks are continuing to lose momentum under the surface despite the market within points of its all-time highs. This can be most clearly seen by looking at the percentage of stocks trading above their 40-day moving average. Since July 18th, that number has dropped from 80% down to 52%.

- The market is showing a decoupling from oil as the rise and fall of the commodity in June, July and now August has not impacted the market substantially.

- Three support levels to watch going forward on SPX is 2168, 2155, and 2147. The breaks are only valid if the price can close below those support levels.

- Dow Jones Industrial Average (DJIA) has a double top that confirms on a move below 18247.

My Trades:

- Did not close out any positions yesterday.

- Added two new swing-trades to the portfolio yesterday.

- May add 1-2 new swing-trades to the portfolio today.

- Will consider adding additional short positions to the portfolio as the market warrants it.

- Currently 20% Long / 40% Short / 40% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone