My Trading Past Performance in Review

You might not have realized it, but March actually snapped a four month winning streak when the S&P 500 decided to close a whooping 0.92 points lower. In percentage terms that was -0.04% lower for the month.

Needless to say there was a lot of chop in the market and that has largely continued into April, but hey, I’m just here to talk about March, there will be a future post on April, once April is finished with itself.

The other two big indices saw the Dow sell off a little bit more, down 149 points or 0.8% and the Nasdaq was the one that bucked the trend by actually rallying 1.5%.

And it was my focus on the stocks listed in the Nasdaq that did me well, including a trade that I made in February in Facebook (FB) that I held up until March 21st when I sold it for a respectable 3.7%.

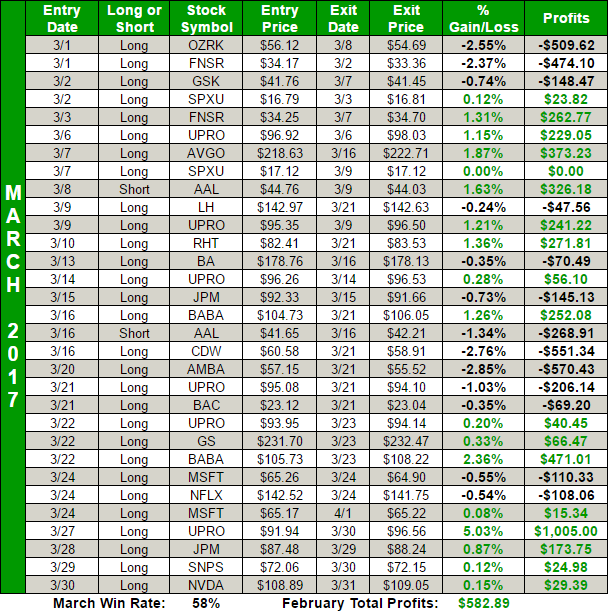

Here’s the breakdown:

- I was correct on 58% of my trades overall.

- 15 out of 27 (56%) trades were profitable that that were focused on bullish/long setups.

- 3 out of 4 (75%) trades were profitable that were focused on bearish/short setups.

My best trade of the month came from UPRO that I played in late March for a 5% bounce – buying it at $91.94 and selling it at $96.56. A good decision when you consider what that 3x ETF has done since.

Even with the largely bearish tone that the market struck in March outside of technology stocks, I still managed to profit on 58% of my trades.

What you have to remember in choppy markets is that you can’t expect to make the same percentage return and that is okay, because you only need to keep the risk/reward the same which you can do regardless of the market. If you can average 6% on an average trade in a strong trending market with a 50% win rate, then you need to keep losses below 3% to keep at least a 2:1 Reward-to-Risk ratio. If the market is trading in a tight and choppy range, then you may only be able to average 3% on your winning trades. In that case, you need to keep your average loss below 1.5%.

In both cases your reward-to-risk stays the same. Dollar amount might be different, but like I always say, quit watching dollars. Your job is to manage risk, and if you aim for a 2:1 reward/risk ratio, you will do just fine.

Overall the month was a quiet one for swing trading, but a profitable one no less.

S&P 500 and the Dow Jones industrial average were down, but the profits in the SharePlanner Splash Zone were up.

One of the keys to market success is to go where the stocks are doing the best. You may have a bullish market, but not all sectors or industries are bullish. For instance, for much of this year, the Russell Index and, in particular, small caps have been down. Trading just small caps thinking that you are going to profit to the long side of the trade probably won’t work well for you. As a result, you have to focus on mid and large caps stocks to net your profits. Another industry that has been solid all year long, and was definitely so in March was the tech sector. Despite the bearishness everywhere else, tech stayed strong.

Another tactic that I employed that worked well for me was playing the bounce in the market. When support was tested, and for all that month we were trading in a sideways range, I would buy UPRO – that worked really well for making a quick buck on the market. And often times the trades were quick ones, lasting only 1 to 2 days. The best of which was the 4 day bounce off of the 3/27 lows where I bought UPRO at $91.94 and sold it on 3/30 at $96.56 for a 5.0% gain.

RELATED: Swing Trading Stock Returns in February

March was all about taking what the market had to give, and what it had to give might not have been exactly what I wanted, but it was something – and that something is what I had to trade off of. Throughout the course of the trading year, there will be months like January and February where everything flows nicely. But there will be other months like March where the market cools off and takes a break. It doesn’t lose much ground, but it doesn’t gain any either. The key though is not to give up any ground yourself, and to continue to improve your portfolio’s worth in the process.

Because the worst thing you can possibly do in trading is go backwards. When you go backwards, that means when you go forwards you are just doing so to get back to where you originally started, and you never want that to be the case.

- Always be moving forward.

- Always be profiting.

- Always be expanding your portfolio’s worth.

If you are looking for a place that can help you trade better, more consistently, or simply help you profit in your trading journey, you need to do yourself a favor and sign up for the SharePlanner Splash Zone. Here you will learn what it takes to profit consistently and regularly and take the mystery out of trading altogether and simply profit regardless of whether it is a bull or bear market. The key is playing the cards the market deals you and you’ll learn this in no better of a place then the SharePlanner Splash Zone.

So Join Today and start your Free 7-Day Trial that you can cancel at anytime. With your membership you will get access to the chat room that I trade in each and every day, as well as all of my real-time trade alerts, that include the entry, stop-loss and target prices that I use as well as the rationale for each trade. These alerts come to you via text, email, and in the chat room. No matter where you are, you can take the Splash Zone with you!