My Swing Trading Strategy

I day-traded TQQQ on Friday, but sold it before the close for a 4.4% profit. I added one additional position on the bounce on Friday, but will be focused on managing the risk and honoring stop-losses this morning on existing positions, with the huge gap lower this morning.

Indicators

- Volatility Index (VIX) – Expect a huge spike today in the VIX today of 20-30% at the open if not more, and a move back over 20. The previous two days of declines are likely to be wiped out today with a big surge higher.

- T2108 (% of stocks trading above their 40-day moving average): An 8.3% bounce on Friday, but I expect last week’s lows to get taken out today.

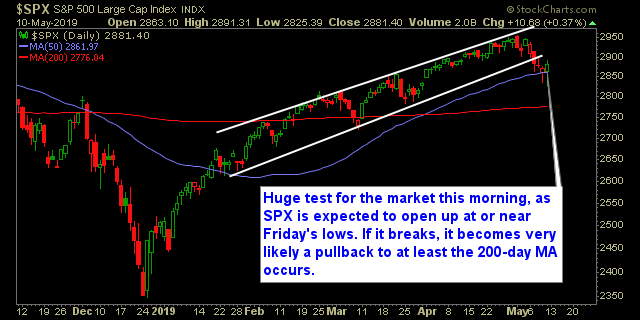

- Moving averages (SPX): This 50-day moving average keeps holding but it will be broken intraday right at the open, and will be a challenge to recapture. before the close of the day.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities led the market bounce on Friday, with all the sectors except for Discretionary finishing in the green. Overall the money was flowing into the safer sectors. Bull flag in the Staples sector, that will likely be challenged by the bears today, but nonetheless, definitely a pattern worth tracking. Watch the Energy stocks today, as China will not be adding tariffs to oil.

My Market Sentiment

SPX keeps showing a willingness to hold that 50-day moving average into the close, but today will be a huge test for the bulls, as there is a major gap below it, and nearly below Friday’s lows. At this point, if the bulls can’t rally the market intraday, I suspect you’ll see a retest of the 200-day moving average again.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long