My Swing Trading Approach

I was stopped out yesterday in Square (SQ) for a +6% profit, and Amazon (AMZN) for a very small profit. I picked up another long position late in the afternoon, looking to play a bounce in the market today. I’ll look to add another long position this morning if the market can hold on to its pre-market strength.

Indicators

- Volatility Index (VIX) – As I mentioned yesterday, expect a bounce off of the 200-day moving average, just as we have previously seen, and we got that with a 17% pop, taking the VIX back over 20, to 20.80.

- T2108 (% of stocks trading above their 40-day moving average): I’m surprised it wasn’t more yesterday, but there was a 13% decline taking the reading back down to 66%, which shows that yesterday was a steady, controlled sell-off.

- Moving averages (SPX): No major damage to the chart yesterday. Managed to close right on the 5-day MA, while bouncing off of the 50-day MA.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities held it together yesterday, as did your other defensive sectors. Plenty of profit taking across the growth sectors, including Energy, Technology, Industrials and Discretionary. Look for that to reverse today, if the market is serious about buying up yesterday’s weakness.

My Market Sentiment

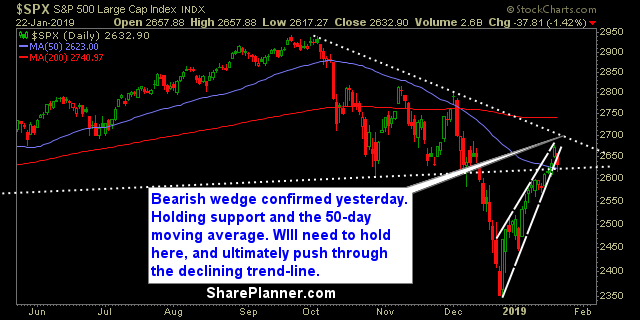

Confirmed a bearish wedge yesterday, but the problem with those patterns is that they can simply form a much less steep, higher-low. Declining trend-line off of the October highs weighs on the market here. Some support found yesterday, that needs to hold again today, as seen in the chart below.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 20% Long.