Swing Trading Strategy:

Futures are rocketing…

Perhaps it is because New York is seeing a drop in the number of deaths, or maybe it is because Trump said a few optimistic words at a press conference yesterday. Either way, the stock market is attempting one of its biggest rallies ever this morning with a monstrous gap higher.

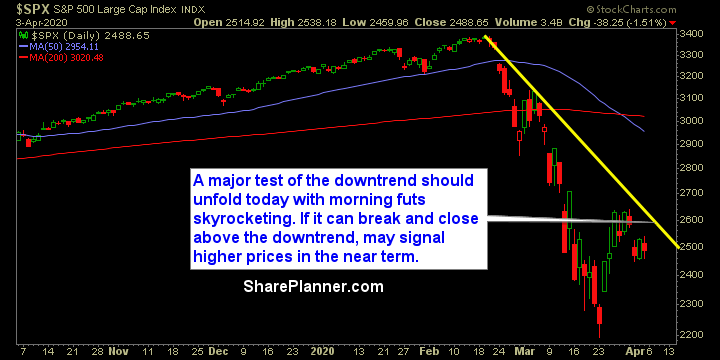

In the meantime, you have a huge downtrend that is in play for the bulls that started at the all-time highs back in February and they will need to break through and close above if this rally should be taken serious going forward (check out my chart below). By the way, the choppiness has to be mentioned here – The market sometimes manages to string together a few days in a row in the same direction, but most of the time it is back and forth price action in a huge daily price range that continues to make this one of the more challenging markets to trade.

Also you have plunging oil from last night that has managed to rebound some, but not having any effect on equities at the moment. The gap up feels good for the bulls, and may repair some of the technical damage of late, but it is very dangerous to put any faith in this market while the economy remains shut down and no real idea when the economy will restart and how that will even look. For me, being primarily in cash right now is the best situation and only testing the waters with small positions continues to be my approach going forward.

Indicators

- Volatility Index (VIX) – VIX is set to drop 5-6% at the open and the lowest reading since March 6th. The indicator continues its free fall after +80 readings last month.

- T2108 (% of stocks trading above their 40-day moving average): Down 4% on Friday, which is essentially a flat day, the indicator sits at 4.5%. Today it should see a big boost with a potential triple digit gap higher.

- Moving averages (SPX): Currently trading below all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

All 11 sectors finished in the red on Friday, with Utilities seeing the most selling out of them all. Relative strength was found in the defensive stocks like Staples and Telecom. Financials, Real Estate and Materials are the biggest concern for the market right now as all of them look like they eventually want to retest their recent lows.

My Market Sentiment