Swing Trading Strategy:

Choppiness and indecision

Yesterday was riddled by reversals and choppiness, as it changed course multiple times throughout the day. While it feels good for the bulls to rally the market 56 points, the breadth is anything but there. For every 17 advancing stocks, there were 13 declining, and that was with a market up 2.3% yesterday. And we keep seeing that with the rallies – poor breadth. For comparison’s sake, on Wednesday when the market sold off over 4% there was a 13:1 ratio in favor of decliners.

I closed my position in SH yesterday for a +2.7% profit, and I closed 1/3 of PSQ for a +3.1% profit. Not bad work. I will look to add some short exposure to the market should things deteriorate today, but also open to the fact that this market may have another face ripping rally up its sleeve.

Indicators

- Volatility Index (VIX) – On the verge of seeing a break down in the VIX, with another decline of 11% that takes it to its lowest reading since March 10th.

- T2108 (% of stocks trading above their 40-day moving average): Up 20% to 4.76% but still unwilling to really push out of the single digits. A break of 6%, which was Tuesday’s highs could signal higher prices for equities.

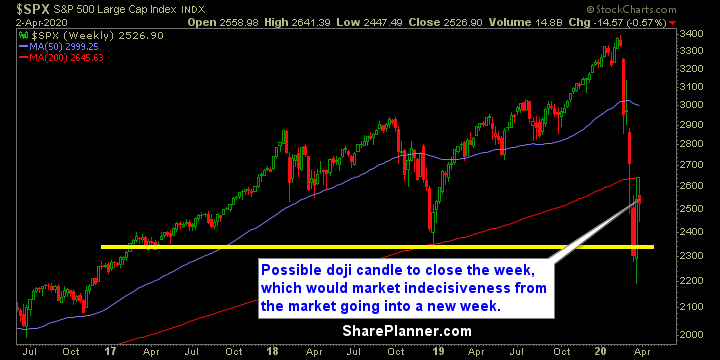

- Moving averages (SPX): Broke above the 10-day MA again, but still unable to push through the 20-day MA.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy was the big winner yesterday rallying 8.6% on a huge run out of oil. Likely to find itself starting out at the top again today. Still not a sector I want to trust, considering it saw over a 60% decline so far this year before finally bouncing. Technology rallied but only about half of what the broader market did, and Discretionary finished at the bottom and the weakest sector of the day, declining 0.7%

My Market Sentiment