Swing Trading Strategy:

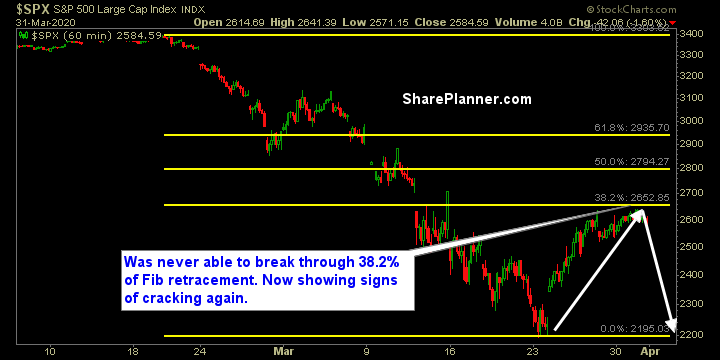

Cracks emerging in the rally…

SPX for a second straight day has been unable to break through the 20-day moving average and, yesterday afternoon started to show some nervous profit takers at the end of the day. Now we have another big sell-off on our hands with the stock market and the potential for another one of those crash-like days.

Today you’ll see a lot more people start to doubt that the bottom from March was the lows, and that may spur them into action towards selling some of their recent positions that they bought off of those lows.

For me, I am coming into the day short on the market, after adding new positions new positions. I may add an additional bearish exposure as the day progresses. Either way, my top goal is to manage the risk, and it will be no different today.

I’m also really about what the breadth will look like today and the volume as the latter has fallen off in recent days and been below its monthly average four straight days.

Be sure to check out my Stock Market Crash Update #5 that I posted this weekend.

Indicators

- Volatility Index (VIX) – Has managed to drift lower 3 of the last 4 days, falling another 6% yesterday to 53.54. However still very elevated and could see a move in excess of 10% that takes the index back to 60.

- T2108 (% of stocks trading above their 40-day moving average): Really mind blowing how much the market has rallied and how this index has only managed to push back up to 5%. Flat yesterday, but overall, the market recovery hasn’t been as strong under the surface as you would have expected.

- Moving averages (SPX): Second straight day where price was unable to break through the 20-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Yesterday saw two sectors rally higher: Energy and Materials. The former did so in dramatic fashion, even with oil struggling. The rally was in excess of +4% and has people talking about buying up a potential bottom here. Utilities on the other hand, struggled and led the way lower, with additional weakness out of Real Estate (which hardly anyone is talking about the incredible weakness in that sector of late) and Financials.

My Market Sentiment