Swing Trading Strategy:

Don’t get your hopes up on a bottom…

While I want to think the worst is behind us, and I hope it is, I’m pretty sure that shutting down the world economy will create consequences that go far beyond the end result of what the Coronavirus brings our way. I’m not trying to minimize the thousands of people that will ultimately die from this horrible virus, but when we reach peak cases, that may not mean the worst is behind us. I hope it does, but deep down I think we may be only at the tip of the iceberg. That is why I am so cautious with my trades, because in the end, I want to remain profitable and achieve my goal of consistently booking gains in the stock market. I remain green on the year for a reason, and that is because when the market gets crazier, I get less crazy. I bought three stocks today in the Trading Block, but sold 1/3 of each position before the close, just to make sure I had some gains locked in because I have little faith in the sustainability of this rally.

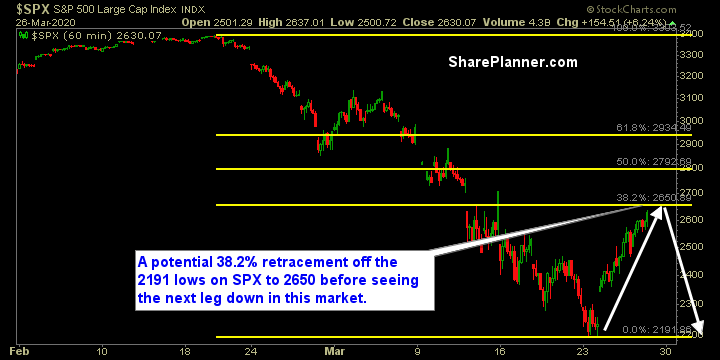

Investors and talking heads are convincing themselves into the notion that the bottom is in this market and that we are at the cusp of a generational buying opportunity. I would love to join them on this call, but simply can’t. I believe that there is more pain ahead, that either sees us retest the Monday lows, or far worse, and if I was a betting man, I would choose the latter. Again, I hope I am wrong, and want to be wrong. I don’t wish this on anyone, but because of the naive mentality that comes with most long-term 401(k) investors, they are likely to experience far more pain in the weeks and months ahead.

In the end, it won’t be the Coronavirus that caused the economic depression but it will be the mechanism that popped the bubble of the most over-exaggerated bull market rally in US history.

My gosh, I feel like a Debbie Downer typing this up, but the more I read and research the effects that this is having on mortgages and banking institutions, the more it makes me think we could be heading towards a repeat of 2008. Again, I hope I’m wrong though it seems like the odds are steadily increasing that I am not.

Indicators

- Volatility Index (VIX) – Unlike recent history, the VIX is not breaking down with every bounce attempt. Instead it remains elevated with a 61 closing, and a small decline relative to the broader market rally.

- T2108 (% of stocks trading above their 40-day moving average): Seriously, we rally 22% over the course of three days and the T2108 is still printing a number below 5%. At this point, I’d expect something in the teens.

- Moving averages (SPX): Nearing a test of the 20-day moving average, and I’d be surprised if it actually broke above it.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Real Estate and Utilities tied each other to lead the market higher. I’m somewhat surprised Technology hasn’t seen more buyers than it has. It has been steady and in the middle of the pack during most of this bounce.

My Market Sentiment