Swing Trading Strategy:

Can we make it two days in a row…

Futs are down about a half percent, but in terms of the kind of shock and awe that has been seen of late, it really doesn’t seem all that bad – almost like a flat opening when you are used to the 5-7% gaps lower or higher. So there is potential here for the bulls to continue the rally from yesterday. It’ll suck in plenty of more buyers but ultimately, I am doubtful that it will lead to anything notable. Eventually, we are probably going to retest the lows again, and possibly even break them.

In the meantime I am open to playing this current market bounce but will do so with caution, and with a very short time frame in mind.

Indicators

- Volatility Index (VIX) – VIX finished flat on the day yesterday, and that is certainly a concern going forward. The previous two days it fell when the market fell, and now rallying when the market is rallying. Very strange, and need more time to watch how the VIX unfolds to draw any conclusions from it.

- T2108 (% of stocks trading above their 40-day moving average): One of the biggest percentage rallies for stocks in the last 100 years, and it was only enough to take the T2108 up 32%, to close at 2.5. Stocks are certainly depressed when so few of companies are able to recapture a 40-day moving average following a 10% rally, but that is the kind of conditions being dealt with right now.

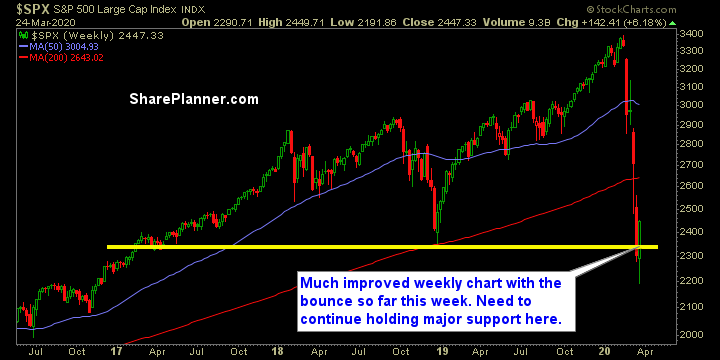

- Moving averages (SPX): First time since March 4th, that a significant trend-line was broken to the upside. Now the 10-day MA is in play, which has been a major deterrent of late.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology was strong, but not a market leader yesterday. Instead, it and Discretionary surprisingly found itself in the middle of the pack. However, their charts are starting to look much better than the rest of the field and would still be my focus going forward. The rally focused on Energy, Materials and Financials.

My Market Sentiment