Swing Trading Strategy:

How low it goes, nobody knows…

Today’s price action was earth-shattering on every level. I mean, could you imagine back in November saying “The Dow is going to rally 3000 points this month!”. Anyone would think you were absolutely crazy to say such a thing. But look at what we did today – we sold off by 3000 points, not in a month, but a single day!

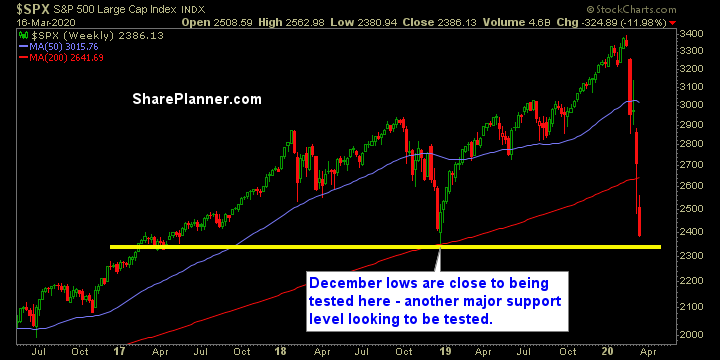

- The S&P 500 sold off 324 points!

- The Nasdaq almost a 1000!.

A market sell-off that was a pure market crash…again!

That’s some crazy stuff. I didn’t add a single position to the portfolio at any point today. I came into today 100% cash and I left 100% cash. And in the process I avoided a market crash entirely. When you can avoid something like that – it puts you so far ahead of the game, it is crazy. I’m not digging myself out of a 12% sell-off. I’ve avoided a 30% sell-off from all-time highs since late February because I chose to simply manage the risk on my trades.

I knew I couldn’t swing-trade this stock market in any capacity on Monday, so you know what I did? I stayed out of the market.

Like the old G.I. Joe cartoon from the 80’s “knowing is half the battle”. If I tried to swing-trade this market, no matter what, I probably stood an 80% chance at failing and the loss probably would be big.

So I abstained – and that is so important. It doesn’t mean you are any less of a trader but it means you are a better one for it.

Where does the market go from here? it could go a whole lot lower, with plenty of dead cat bounces in between and if it does – just let it be. If a good trade setup arises with an ideal risk/reward and a decent level of predictability in terms of outcome, then go for it. but a low probability trade and high risk outcome is what you want to avoid.

If the bulls rally 300 points tomorrow, I am okay with that. I’m avoiding so much loss, and that counts for so much!

Indicators

- Volatility Index (VIX) – Are we going to hit 100? Just maybe I mean look at what it did today – it rallied like gangbusters by 43% higher to close at 82.69. Consider that 2008 never got higher than 89. The fear in this market is astronomical at this point.

- T2108 (% of stocks trading above their 40-day moving average): It didn’t break Thursday’s lows, but at this point considering how rock bottom it is, it really doesn’t matter. It closed 45% lower at 1.64%.

- Moving averages (SPX): Currently trading below all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Real Estate is typically one of the safer plays in a market sell-off. Today it led the entire market lower at an 18% clip. Energy came in right behind at 14% and Financials were 13% lower. It is a huge concern for Technology to see a 13% decline as the market’s most popular stocks are being decimated.

My Market Sentiment