Swing Trading Strategy:

Is this the bottom…

There are plenty of people out there that love to tell you that this is the bottom, or others who will say this is a temporary relief rally, aka ‘dead cat bounce’. But in all honesty – none of them know, or have any ability to know for sure. I’m just one of the few honest ones that will say “I don’t know”. Successful trading isn’t about knowing the future, it is about managing the risk. When the risk can’t be managed according to your plan, you have to trade less and fewer positions. I am coming into today 100% cash. I will dip my toes into the water at the open, and I’m totally fine with that. If it doesn’t work out, then I hop back out and all is fine.

There are plenty of people out there blowing up accounts and funds and like 2000, 2008, 2010, 2018, I get through these crazy market moments and live to trade another day while keeping my profits along the way.

And I sleep well at night too!

Indicators

- Volatility Index (VIX) – VIX was looking, overnight at a potential move into the 80’s, which is where the 2008 peak took us .That doesn’t look to be the case today. However, yesterday was astonishing – a 40% move to 75.47 that could very easily mark a top in the Fear Index.

- T2108 (% of stocks trading above their 40-day moving average) It closed at 1.28% following a 43$ decline yesterday. This is an insane reading and one that would typically market a temporary bottom.

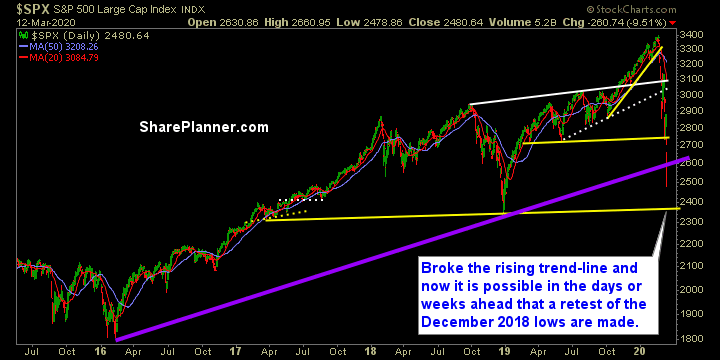

- Moving averages (SPX): Currently trading below all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Everything was incredibly awful yesterday. Energy continues its free fall and will likely be one of the biggest benefactors of a market rally today. Technology has been relatively stronger than you’d think during this sell-off, as Industrials and Financials have been the much bigger targets along with Materials.

My Market Sentiment